Driving better business outcomes with the AP aging report

Managing cash flow while maintaining strong vendor relationships is a constant challenge for accounts payable teams, but essential to sustaining business growth and operational efficiency. The AP aging report is an important tool that can help businesses achieve these goals.

The report provides accounts payable teams with a detailed view of outstanding invoices, helping them prioritize payments, avoid late fees, and improve overall cash flow management. It’s not just about keeping track of invoices—the report plays a key role in helping teams make data-driven decisions that impact vendor relationships and financial health.

By using the AP aging report, businesses can ensure timely payments to vendors and take a proactive approach to cash flow optimization. Keep reading to learn why this report is important and how your team can use it to improve financial processes and drive better business outcomes.

Key takeaways

- The AP aging report helps accounts payable teams prioritize suppliers payments, strengthening vendor relationships. Timely payments prevent disruptions and open opportunities for early payment discounts.

- Using automation improves the accuracy of your AP aging report, reducing errors like duplicate invoices and late payments. Automation also streamlines the process, freeing your team from manual tasks and reinforcing internal controls and fraud prevention.

- Visibility into outstanding liabilities enables better cash flow management. AP teams can make strategic decisions about when to pay invoices, optimize days payable outstanding (DPO), and maintain vendor trust.

What is the accounts payable aging report?

The AP aging report includes a list of vendors and the payment due dates associated with their outstanding invoices. This report can help teams prioritize invoice payments across suppliers while managing cash flow. Since vendor relationships are key in driving business forward, these insights are essential for companies operating in today’s marketplace.

What information is in the AP aging report?

The AP aging report contains the following information and details:

- Invoice data and supplier information: The AP aging report showcases important payment information, such as the invoice date and vendor account data.

- Due dates: Invoices are sorted into aging categories. Dates are typically sorted by 30-day intervals.

- Total costs: The invoice costs will be calculated in the AP aging report. The report also showcases how much companies owe in liabilities based on the aging category selected and identifies invoices that offer early payment discounts.

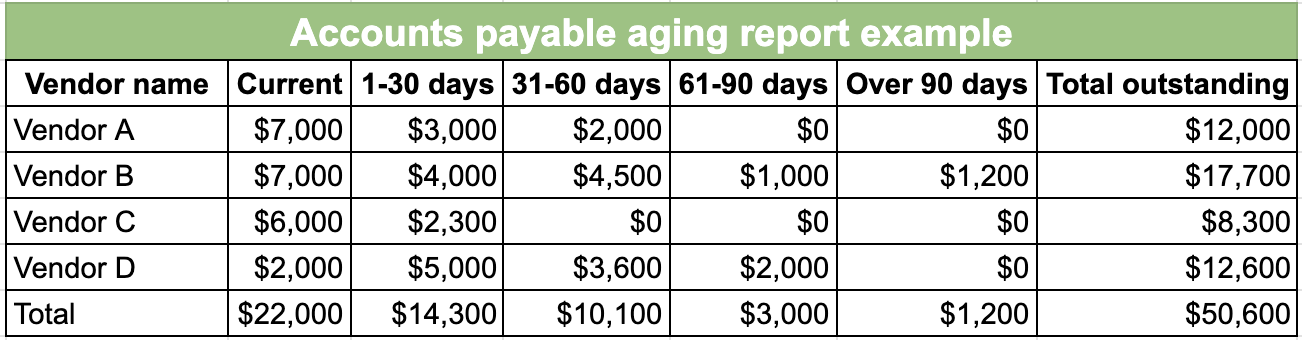

Example of an accounts payable aging report

Let’s examine the sample report below to better understand how it works. It categorizes outstanding invoices by the number of days they’ve been unpaid, giving a clear picture of a business’s liabilities.

The accounts payable aging report is typically divided into the sections below, helping businesses prioritize payments and cash flow management more effectively:

- Current

- 1-30 days

- 31-60 days

- 61-90 days

- Over 90 days

Reviewing this report regularly helps businesses stay on top of their financial obligations and avoid late fees or damaged relationships with vendors.

Benefits of the accounts payable aging report

There are several benefits for organizations leveraging the AP aging report. Let’s take a closer look at the top five below.

1. Improve vendor relationships

According to research from MineralTree’s 8th Annual State of AP Report, vendor relationships continue to grow in terms of importance. By paying suppliers on time, teams can ensure that operations continue to run smoothly.

AP aging reports showcase what still needs to be paid, as well as any late payments and their overdue status in 30-day increments. By regularly reviewing this information, AP teams can easily focus on paying the most important invoices first. AP aging reports can also alert teams to opportunities to negotiate better payment terms or extended payment windows with vendors for certain balances before those payments are flagged late.

Did you know? An AP solution like MineralTree makes it easy to sort invoices by the payment due date automatically so that finance teams can ensure suppliers are getting paid on time.

Check out the infographic to uncover 5 ways to improve vendor relationships.

2. Be more strategic about DPO

Manual processes incite teams to be more reactive when it comes to invoice payments. With the traditional AP check run, invoices are generally processed as soon as possible. However, a longer or shorter DPO can have a big impact on the business, including supplier relationships or cash flow.

However, with the right tool, teams can more quickly filter through the due dates for pending invoices, so they can be more strategic in their payments. If teams are also taking advantage of AP automation technology software, they can schedule these payments to maximize DPO without penalizing their relationship with their suppliers.

3. Find errors while improving efficiency

Research shows that 94% of organizations are looking to mitigate the impact of inflation. Manual errors that result in mistakes drive costs for organizations. Mitigating errors is essential when driving efficiency across the financial department.

An AP aging report makes it easier to address accounting errors, such as duplicate invoices and late invoices. As a result, teams can combat these mistakes to ensure that everything is processed correctly the first time.

4. Improve cash flow

According to McKinsey, the pandemic underscored the company’s need to focus on cash since organizations without sufficient funds struggled to pay suppliers as the crisis worsened. McKinsey notes that organizations should “take a more strategic posture on accounts payable to conserve cash while maintaining relationships with suppliers and vendors.”

When teams use the AP aging report, they can make strategic decisions on when to pay invoices. However, they can also see upcoming bills, giving them more data on how future payments and AP may affect their cash flow.

5. Prevent fraud

Phishing attacks are on the rise, with 61% of survey respondents reporting a year-over-year increase. To combat fraud attacks, strong internal controls in accounts payable are important.

The AP aging report is important in supporting internal controls since it gives a clear overview of all outstanding liabilities. These reports can also help teams identify inconsistencies across vendor information or incorrect supplier information.

How to create an AP aging report

Creating an AP aging report ensures your accounts payable team has clear visibility into outstanding invoices and can prioritize payments effectively. Below is a step-by-step guide to help you get started.

1. Gather invoice information

Collect all relevant data on outstanding invoices, including:

- Invoice numbers

- Vendor names

- Payment terms

Did you know? An AP automation solution like MineralTree can help centralize and organize your data efficiently.

2. Determine time frame

Set the date ranges for the invoices that are due, typically in 30-day intervals (0-30 days, 31-60 days, 61-90 days). This helps prioritize late payments, with anything within 0-30 days being marked as more urgent. Also, consider identifying invoices that offer early payment discounts. By paying certain vendors early, your business could take advantage of discounts that improve cash flow.

Did you know? Tracking early payment opportunities within your AP aging report can help you increase savings while maintaining strong vendor relationships.

3. Organize invoices by aging category

Sort invoices based on their payment due dates into their respective aging categories. You can also organize invoices based on suppliers so teams can determine if there are any trends related to specific vendors.

Did you know? Automating this process by using an AP automation solution like MineralTree ensures accuracy and efficiency, especially when dealing with high volumes of invoices.

4. Calculate the total amounts owed (if you’re manually creating the report)

If you’re creating the report manually, calculate the total amount owed for a clear understanding of outstanding liabilities and help with cash flow forecasting.

5. Review the report for accuracy (if you’re manually creating the report)

This step is also for AP teams that are creating the report manually. Before finalizing the report, review it for discrepancies and errors like duplicate invoices or incorrect payment terms.

Did you know? Using AP automation software like MineralTree can help you generate AP aging reports automatically, ensuring that your data is always up-to-date and accurate. Regularly updating your AP aging report and automating the process lets your team proactively manage payments, avoid late fees, and optimize cash flow.

Improving the accounts payable aging report process

While the AP aging report is a straightforward process, there are several ways teams can improve the process. Let’s take a closer look below.

Focus on data accuracy

Reports can only be as accurate as the data that is being pulled. Challenges in this process can occur when invoices are collected via various methods, such as mail and email. Teams should have a dedicated email for invoices, where these are automatically uploaded into an invoice storage system.

Additionally, it’s important to flag duplicates and ensure vendor information is accurate. By ensuring that information is as accurate as possible before pulling the data, teams will be able to get more use out of the AP aging report.

Pull reports consistently

By regularly reporting on this data, teams can mitigate the number of late payments their organization has.

Reconcile your invoice payments

Compare your AP aging report with the general ledger to determine if there are any discrepancies in the data. These mismatches can help teams flag fraudulent payments or human error.

Automate the process

AP automation tools can automatically generate these reports so that finance teams don’t need to waste time sifting through paper invoices and emails to pull the data. As a result, teams can generate this report more consistently to gain better insight into payment due dates.

Maximize your AP efficiency with the right tools

Having the right AP reporting and analytics tools in place is key for teams looking to leverage data more effectively. The AP aging report provides a clear view of outstanding liabilities, helping businesses improve cash flow, strengthen vendor relationships, and take advantage of opportunities like early payment discounts.

MineralTree’s AP automation solution provides insights into the AP aging report and helps teams report across various metrics, including DPO, history of payments, and payment mix. AP teams can use MineralTree to be more strategic in their roles.

See how MineralTree can help you optimize your AP processes. Request a demo today.

AP aging report FAQs

Tl;dr? If you’re short on time the frequently asked questions below provide a quick snapshot of what you need to know about the AP aging report.

1. Why is the AP aging report important for auditing?

The AP aging report helps teams identify discrepancies that may exist in their general ledger and can highlight accounting errors, such as duplicate payments.

2. What is the difference between the AP trial balance and the AP aging report?

The AP aging report focuses on all outstanding invoices and is sorted by date. This report helps teams sort through invoices and prioritize payments. The AP trial balance shows unpaid and partially paid invoices. This is used to help businesses ensure the outstanding liabilities are correct.

3. How often should I review my company’s AP aging report?

AP teams should review accounts payable aging reports on a weekly or monthly basis to ensure timely payments and optimize cash flow management.

4. What are the most common issues found in an AP aging report?

Common issues include duplicate invoices, overdue payments, and discrepancies between the report and general ledger. Regular reviews can help catch and resolve these errors.

5. How does AP automation improve the AP aging report process?

AP automation eliminates manual, timely, and costly errors. Automation also ensures reports are up-to-date, allowing AP teams to focus on more strategic tasks like cash flow optimization.

6. How do early payment discounts appear in the AP aging report?

Invoices with early payment discount opportunities are flagged, allowing businesses to prioritize payments that offer financial savings.

7. Can AP aging reports help prevent fraud?

Yes, these reports provide visibility into outstanding payments, helping teams spot unusual vendor activity or discrepancies that could indicate fraud.