AP reporting often falls low on the priority list for finance departments. For valid reasons. When AP teams are too busy chasing down invoice approvers or responding to vendor inquiries, they don’t have time to draft a strategic plan for reporting – let alone actually run it. Unfortunately even the teams that manage to find the time for manual reporting are frustrated with its time-consuming, cumbersome process.

But AP analytics offers valuable insights for teams able to find them. And ignoring AP analytics only leads to more problems down the line. In fact, failing to leverage AP reports can make it difficult for businesses to streamline various finance processes, save costs, and improve vendor relationships. Thankfully, today’s AP reporting and analytics has never been more accessible. Many teams leverage AP automation to quickly extract their desired data to accurately forecast and manage their cash flow. Keep reading to learn more about the importance of accounts payable analytics, which reports can improve business operations, and how AP automation improves the reporting process.

An Overview of Accounts Payable Reporting and Analytics

Reporting and analytics are closely related terms with important distinctions. Reports provide transactional information for a business. They are useful when looking for specific information or to reconcile accounts. Analytics, on the other hand, transform this reporting data into meaningful business insights and metrics related to KPIs. These analytics help teams determine how to optimize their payment mix and identify a list of strategic vendors.

Together, reporting and analytics summarize and distill important data in a way that is useful for an organization. Reports consolidate disparate information into a single document so that it is easier to visualize while analytics shows patterns and details that might otherwise be missed. Their combined power can help your team more effectively manage AP and make better business decisions.

What are Accounts Payable Reports?

Accounts payable reports are a collection of financial documents that track a businesses unpaid, paid, upcoming, and past due invoices, and are an essential tool for businesses of all sizes. AP reports give businesses visibility into their finances which helps them to understand cash flow, build strong vendor relationships, take advantage of early-pay discounts, as well as reduce the risk of fraud.

Why Reporting and Analytics Matter in AP

While the main role of the accounts payable department is to process invoices and render payments, it’s important not to overlook their responsibility of reporting and analytics. These insights guide decision-making and ultimately streamline processes and improve cash flow. Below are some of the key benefits of reporting and analytics in AP:

Vendor relationship management

In a recent State of the AP report, 71% of surveyed businesses said their vendor relationships grew more important over the past year. Businesses depend on their partnerships to get products made and shipped globally. Since these relationships are growing in importance, businesses must maintain strong relationships with their suppliers. Timely payments and visibility into the financial payment process can result in a more positive experience for the vendor.

Analytics provide insights into important metrics such as typical payment times or budget spent for individual vendors. By tracking these metrics, firms can then set goals to improve them over time. Analytics can also help teams determine which suppliers are most strategic for their business and whether or not they need to lower the DPO.

Good financial records

Reporting and analytics also provide financial information in a clear snapshot, so that employees can make better business decisions. This quick overview is extremely useful and much easier to interpret than looking through records one transaction at a time.

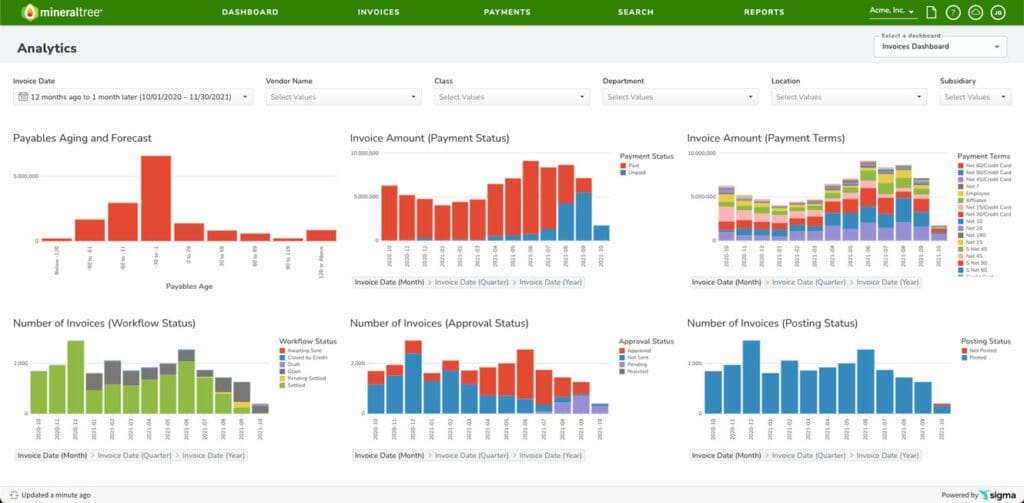

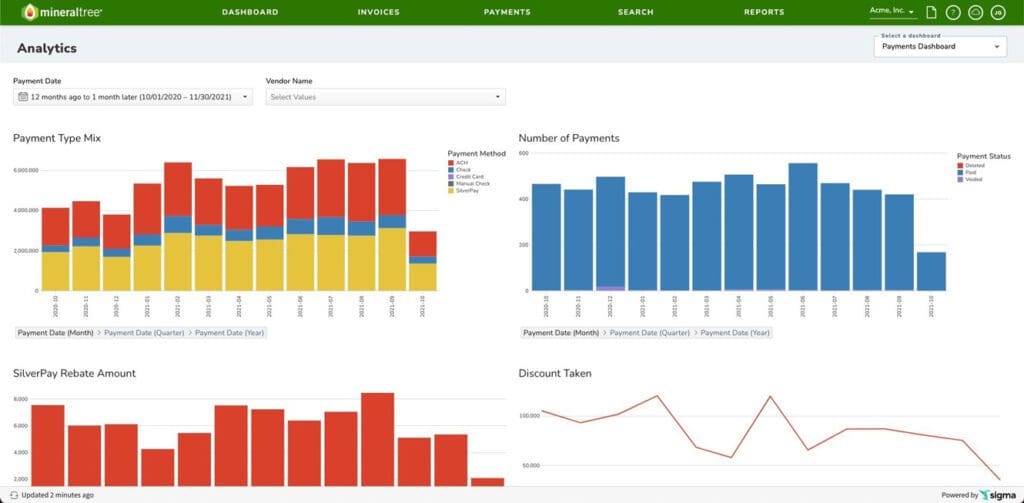

An AP automation solution with built-in analytics capabilities can even provide a convenient dashboard to centralize all of the information you want into a single view. This automatic approach eliminates the need for AP team members to run time-consuming reports, leaving them free to focus on less tedious, more strategic tasks.

Note that most ERP systems only display data once it has processed the relevant invoice. In contrast, an AP automation solution like MineralTree lets you use the data as soon as an invoice is captured, making invoice tracking and accruals much easier.

Challenges in Reporting and Analytics

Building reports and analyzing AP data requires a certain amount of knowledge and expertise. Unfortunately, most AP department employees lack the relevant experience. This is one of the biggest challenges with reporting and analytics. Even teams with skilled employees that know how to run reports must often spend long hours putting them together.

This is just one draw-back of manual reporting and analytics. Aside from the slow timeline, this traditional approach is prone to human error and often leads to accuracy problems. Not to mention, by the time the report is complete, the data may no longer even be up to date. Ideally, reports should be automatic and built off of live data feeds so that decision-makers can act on them quickly with confidence.

Some organizations also face challenges when adopting analytics if they haven’t worked with interpreting data and reports before. They must be able to understand what the report is conveying. This is true whether the report is manually generated, or they are viewing an automatically generated dashboard of information.

What are the Different Types of Accounts Payable Reports?

By understanding some of the most popular and relevant types of accounts payable reports, you’ll be better able to interpret their results. Below are six kinds of AP reports and metrics that are key to business success.

DPO Reports

Days payable outstanding (DPO) is a ratio that measures the average number of days it takes to pay invoices. It is computed by taking the product of accounts payable and number of days and dividing it by the cost of goods sold.

It’s important to note, there is no universal “good” or “bad” value for DPO as it depends entirely on your business’ unique goals. For example, if you consistently pay vendors late, you will want to decrease your DPO. You may also want to decrease your DPO if a vendor offers early payment discounts. In other cases, however, lengthening your DPO (assuming you are still rendering payments by their due dates) can optimize cash flow by keeping funds in your accounts longer.

AP Trial Balance

An AP trial balance report shows all unpaid and partially paid invoices by vendor. This visualizes data to show how much money your business owes to its suppliers. This report ensures that the total AP liabilities are accurate and accounted for. It’s especially helpful for reconciling balances with your bank for proper financial reporting.

History of Payments

The history of payments report shows all invoice payments made to each vendor, including the forms of those payments (check, ACH, virtual card payment, etc.). The insight provided into the payment mix enables better decisions about rebalancing the mix to take advantage of virtual card rebates or reducing the number of paper checks being mailed.

Teams can also leverage this report to determine where to cut costs on more expensive types of payments like checks. For example, recent data shows 82% of suppliers would like to receive more electronic payments. An invoice-to-pay solution, like MineralTree, will enroll and onboard strategic vendors, making it easy for them to use electronic payment methods which are cheaper, faster, and more secure for your team.

This report also visualizes vendor spend over time, which is particularly useful for reconciliation, particularly when it comes to payments via check since they are listed in their own category. Check payments are notoriously one of the most difficult to reconcile as they take longer to deliver and require the receiving party to deposit them before they appear on your bank statement.

Voucher Report

Voucher reports, or voucher activity reports, are generated by using specific search criteria to identify payment vouchers over a specific period of time. This type of report can show spending within a particular department or on a particular project. It allows the reader to trace spending that falls under a specific category.

AP Aging Report

AP aging reports include a list of vendors along with the amount of payments due to each of them. Aside from showing the total amount owed to each vendor, AP aging reports can also break down amounts owed over different time periods such as 1-30 days, 31-60 days, and so on. These reports provide a clear view of which accounts are due the soonest and should be paid first. These reports are particularly helpful for companies facing supply chain issues.

An AP automation solution, like MineralTree, also makes it possible to sort invoices by payment due date. This is another simple tool to identify which suppliers to pay first. This additional insight on your payment platform can help your team optimize its DPO.

Reconciliation of Accounts

An AP accounts payment reconciliation report shows the total amounts owed to each vendor, along with all associated accounting activities. The debts listed in this report are often referred to as liability accounts. Individuals can then compare these liability accounts with the general ledger for reconciliation purposes. In this way, the report makes it easy to identify errors, incorrect payments, and delinquent accounts.

Simple Mills: A Case Study in AP Reporting and Analytics

As a leading provider of better-for-you snacks, Simple Mills is always looking for ways to improve processes to improve the holistic health of people and the planet. To that end, it sought an AP automation solution that could support its growing invoice volume without adding staff headcount. After previous attempts had come up short, Simple Mills turned to MineralTree for an end-to-end AP automation solution.

By adopting automation with the help of MineralTree, Simple Mills unlocked powerful analytics with the ability to instantly view important metrics and KPIs through the platform. This has enabled them to review and manage approval thresholds, examine what might happen by extending payment terms, and generally improve decision-making. “MineralTree Analytics has unlocked our AP data, so we can analyze annual spend, vendor terms, and the impact of early pay discounts on our cash flow,” said Maddy McGannon, Simple Mills’ Controller. “Supplier relationships and cash flow are both strategic priorities for us, and MineralTree Analytics helps us maintain a proactive and data-oriented approach at all times!”

Improving the Reporting Process

Improving the reporting process looks different for every business, regardless of their size and industry. Yet there is one rule that applies to all reporting: having the right reporting tools is key to achieving success. When it comes to AP reporting and analytics, AP teams should leverage a platform that can tap into real-time information and provide immediate access to reports, KPIs, and analytics.

Educate employees on the meanings and interpretation of different available reports in order to improve reporting on your team. By enabling the team to understand what is important and why, they can better track, revisit, and make data-driven decisions.

The MineralTree platform provides a wide array of solutions, from virtual cards, ERP integrations, and vendor onboarding, to complete, end-to-end AP automation with TotalAP. Studies have shown that businesses can triple their efficiency and reduce costs by as much as 430% by adopting an end-to-end solution. Request a demo to learn more.

AP Reporting FAQs

What’s the Difference Between Reporting and Analytics?

Reports provide transactional information for a business while analytics transform this reporting data into meaningful business insights and metrics related to KPIs.

What are the Most Common AP Reports?

The most commonly used AP reports include DPO reports, history of payments report, AP aging report, reconciliation of accounts report, AP trial report, and a voucher report.

Why is AP Reporting Important?

AP reporting is important for businesses to create visibility into their finances which helps them to understand cash flow, build strong vendor relationships, take advantage of early-pay discounts, and reduce the risk of fraud. CFOs can also use these metrics and KPIs to gain a better sense of the financial stability of the company.

What is an Open AP Report?

An open AP report is a report that shows all bills that still need to be paid.