What CFOs need to know about Sage Intacct

The role of the CFO is rapidly evolving, with cross-functional collaboration and strategic decision-making becoming fundamental aspects of the position.

As CFOs take on these expanded responsibilities, leveraging the right tools becomes even more important. Sage Intacct is designed to meet the needs of modern CFOs, offering a comprehensive suite of features that streamline financial operations and support strategic initiatives. By integrating Sage Intacct with an accounts payable (AP) automation solution, you can transform your processes for greater efficiency, accuracy, and security in your financial operations.

Key takeaways

- The role of the CFO is rapidly evolving, with an increased emphasis on strategic decision-making, cross-departmental collaboration, and digital transformation.

- Key benefits of Sage Intacct for CFOs include cloud-based access, advanced financial management capabilities for precise reporting and analytics, and seamless integration with other systems.

- Integrating Sage Intacct with third-party AP automation tools can help CFOs capture more accurate data, significantly boost operational efficiency through automation, and enhance payment security through automated processes and advanced fraud detection.

The evolving role of the CFO

The role of the CFO has evolved in recent years, from increased cross-functional collaboration to a rising focus on digital transformation. Below are some ways the role has evolved:

1. Collaboration with the C-suite and across departments

Research from Sage Intacct shows that the CFO’s role has become 30% more collaborative across departments. This shift requires CFOs and controllers to contribute strategically across the entire organization. By working closely with other departments, CFOs can drive better decision-making and align financial strategies with overall business objectives.

2. Technology and digital transformation

CFOs are at the forefront of digital transformation, leveraging technology to drive efficiencies and support strategic initiatives. Integrating digital solutions like Sage Intacct and automation tools allows these executives to streamline routine tasks, freeing up time for strategic initiatives while improving efficiency across the financial department.

3. Company strategy and business growth

CFOs play a larger role in shaping business strategy and driving growth. They are now required to formulate strategies that leverage financial insights to support overall business objectives. This expanded role highlights the importance of having accurate and timely financial data.

Important Sage Intacct features for CFOs

Sage Intacct offers various features that enhance day-to-day efficiency and accuracy in your team’s financial operations, such as:

- Automation

- Security

- Advanced reporting

- Budgeting and forecasting

Let’s take a look at each feature in more detail below.

Automation

Automation is a game-changer for finance departments, streamlining financial processes and minimizing the risk of human error. Sage Intacct automates key functions such as AP, accounts receivable (AR), and financial close processes, ensuring that the data you draw on to make strategic business decisions is always up-to-date and accurate. Additionally, Sage Intacct does offer the ability for companies to integrate third-party tools, which can further automate these processes.

Security

With the increasing frequency of data breaches, security has become even more important to finance departments. In 2023, 8 out of 10 companies reported being victims of a payments fraud attempt or attack, a number that has grown by 15 percentage points compared to 2022. Sage Intacct offers robust security features to protect sensitive financial data, helping companies confidently manage operations.

Advanced reporting

A survey by CFO Dive found that 79% of senior finance leaders consider problem-solving skills among the most crucial attributes of a CFO. Effective problem-solving hinges on having accurate data and advanced reporting capabilities. Sage Intacct provides real-time visibility into your financial performance, enabling data-driven decisions.

Budgeting and forecasting

Sage Intacct’s budgeting and forecasting tools allow teams to create precise financial plans and adjust them as needed. As a result, financial leaders can accurately forecast cash flow and make adjustments to plans based on challenges faced by CFOs today, such as inflation and accounting staff shortages. This flexibility is vital for navigating the uncertainties of today’s business environment.

What are the main benefits of Sage Intacct for CFOs?

Sage Intacct offers various benefits, including robust scalability to support business growth and seamless integration capabilities with other business systems. It also provides real-time financial insights and automation tools that enhance efficiency and accuracy in your financial management. Main benefits include:

- Cloud-based platform

- Robust financial management capabilities

- Scalability

- Integrations

- Compliance

Keep scrolling to take a deeper dive into these benefits.

Cloud-based platform

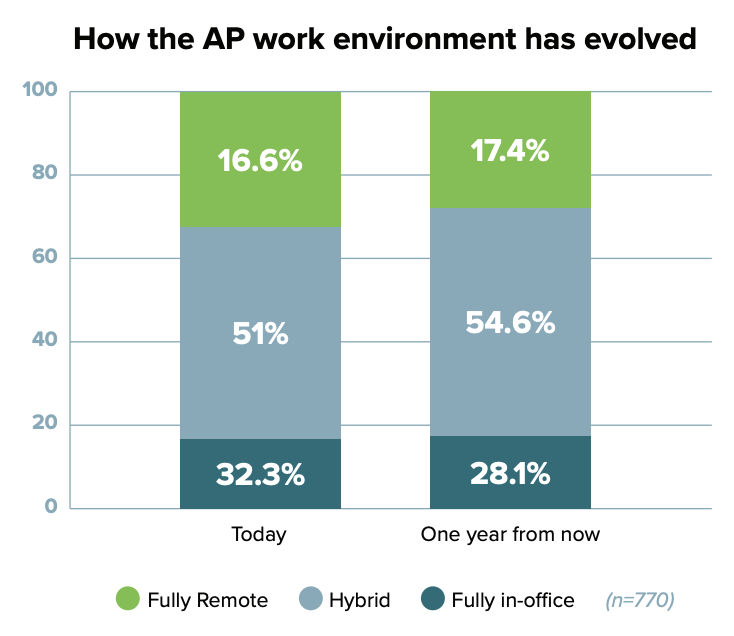

Sage Intacct’s cloud-based platform allows teams and financial leaders to access data from anywhere. This flexibility is especially beneficial in today’s remote and hybrid work environments. According to MineralTree’s 8th Annual State of AP Report, 51% of teams are hybrid and 16.6% are fully remote. The ability to collaborate is important to remain competitive in today’s environment.

Cloud-based systems also tend to offer more robust security benefits. They don’t require additional IT resources, and patches can be implemented without downtime.

Robust financial management capabilities

Sage Intacct provides robust financial management capabilities, including real-time visibility into financial data, automated processes, and comprehensive reporting and analytics. These features enable you to manage finances more efficiently and strategically.

Scalability

As your organization grows, financial management needs become more complex. Sage Intacct scales with your business, offering the tools necessary to handle increasing financial complexity, such as sophisticated reporting tools. You can also add new users without disrupting existing operations.

Integrations

Sage Intacct integrates with a wide range of systems, ensuring a unified approach to financial management. This capability is crucial for maintaining operational efficiency and business continuity as financial leaders adopt new technologies. Additionally, these integrations can bring more value to the Sage Intacct tool. For example, an AP automation tool can help teams better manage payments, without needing an expensive customizable solution.

Compliance

Compliance is a moving target, with regulations constantly evolving. Sage Intacct helps companies stay compliant by automating compliance processes and providing timely updates on regulatory changes.

6 ways AP automation can further streamline processes for CFOs

It’s clear that Sage Intacct offers numerous benefits that can significantly enhance your financial processes. Integrating Sage Intacct with an AP automation system can further streamline operations and boost efficiency in multiple ways.

1. Gain more accurate data for better forecasting

CFOs typically must wait for invoices to be processed before leveraging related data. AP automation lets teams use data upon invoice capture, providing faster financial insights that inform decision-making and enhance cash flow while forecasting the impact of accounts payable on the business. This capability is crucial as the role of the CFO increasingly involves providing strategic counsel for the business.

2. Do more with less

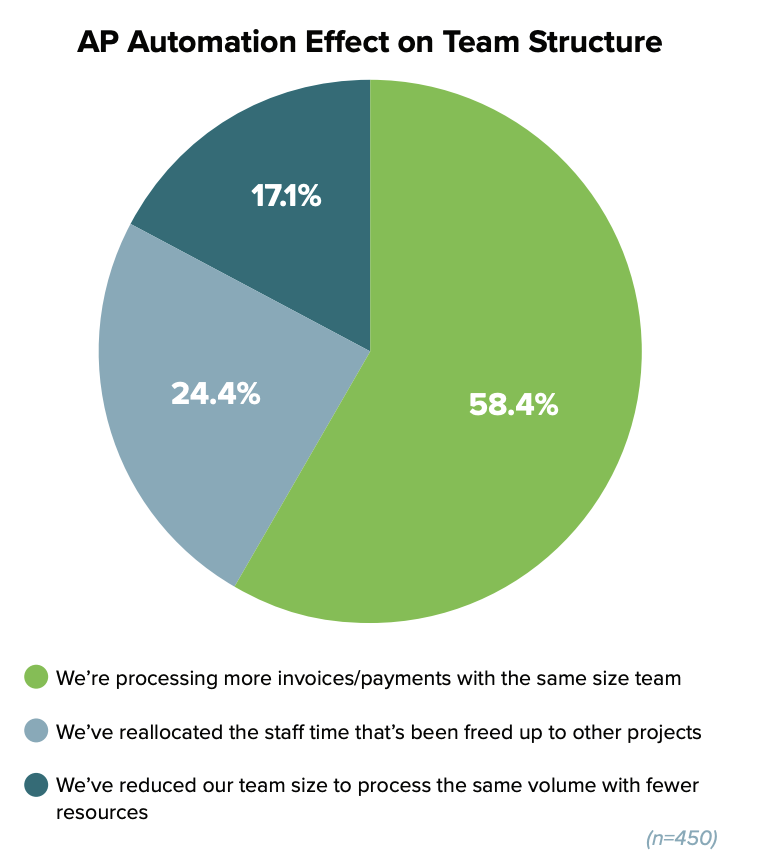

Many businesses are under pressure to do more with fewer resources. According to the MineralTree’s 8th Annual State of AP Report, 58.4% of finance teams using AP automation tools can manage more invoices without increasing headcount. This increased efficiency allows you to redeploy teams into other areas of the finance organization or dedicate time to more strategic initiatives.

3. Embrace digital transformation

Managing a growing number of responsibilities can make it difficult to maintain efficiency. Digitally transforming your finance operations can boost productivity and handle increased workloads more effectively with automation.

4. Boost payment security

AP automation enhances payment security through features like Positive Pay and protections against vendor fraud. Positive Pay automatically verifies checks against issued payments to detect discrepancies, while advanced fraud detection algorithms monitor transactions for unusual activity. By reducing manual intervention, AP automation minimizes human error, further strengthening the integrity of your financial operations.

5. Get more insight out of AP analytics

AP automation technology like MineralTree can offer valuable insights into the payment process. Access to these insights empowers you to identify cost-saving opportunities and optimize your financial strategy. For example, Simple Mills used MineralTree to analyze payment data, such as vendor spend, to enhance business decision-making and boost productivity.

6. Ensure Sage Intacct remains the system of record

Third-party AP automation solutions that offer bi-directional sync ensure that Sage intacct maintains data consistency and accuracy across platforms. This capability enables seamless integration while reducing manual data entry.

Did you know? MineralTree’s API provides true bi-directional sync so that data is accurately reflected across both platforms.

Case study: Ladera Winery transforms AP efficiency with Sage Intacct and MineralTree

Ladera Winery, one of Napa Valley’s most respected family-owned wineries, faced significant inefficiencies in its manual AP processes. As the winery expanded, the traditional paper-based workflow—relying on physical approvals and manual data entry across multiple locations—became increasingly time-consuming.

The reliance on physically transporting invoices for approval and manual data entry created delays and added labor costs. The lack of integration between their AP system and Sage Intacct further complicated financial management and reporting.

Ladera Winery was able to automate their invoice processing and payment workflows by implementing MineralTree’s AP automation solution, drastically reducing the manual workload and eliminating the need for paper-based processes.

Ladera Winery implemented MineralTree’s AP automation solution to address these challenges. This change allowed them to automate their invoice processing and payment workflows, drastically reducing the manual workload and eliminating the need for paper-based processes. The seamless integration with Sage Intacct improved data accuracy and speed of transactions, cutting the time spent on AP tasks by 70%. Additionally, the flexibility and remote access provided by MineralTree enhanced overall visibility and control, enabling Ladera to streamline operations and achieve substantial cost savings. The investment in MineralTree paid for itself within the first 60 days of use.

Final thoughts

As the CFO’s role continues to evolve, one constant remains: the need for efficiency and automation in your financial processes. Sage Intacct provides the robust features you need to manage your workload more effectively.

Integrating Sage with MineralTree allows CFOs to further streamline operations, reduce manual errors, and gain deeper insights into financial data. As a result, financial leaders can focus on driving business growth, supporting strategic initiatives, and making informed decisions that benefit your entire organization. Learn how MineralTree can help. Request a demo today!

Simplify vendor payments directly from Sage Intacct

MineralTree and Sage partnered to make vendor payments seamless–directly from your Sage Intacct instance.

✔️ No sync issues

✔️ No new bank accounts

✔️ No integration headaches

Vendor Payments powered by MineralTree is fully embedded within Sage Intacct and works with your existing AP process.

Sage Intacct for CFOs FAQs

Tl;dr? If you’re short on time the frequently asked questions below provide a quick snapshot of what you need to know about Sage Intacct for CFOs.

1. How is the role of the CFO expected to continue to change?

The role of the CFO will continue to evolve toward greater strategic involvement and collaboration across the organization. CFOs will also continue leveraging technology to drive efficiencies and support business growth. As businesses face more complex financial landscapes, CFOs will play a key role in guiding strategic initiatives, driving innovation, and fostering cross-departmental partnerships to achieve organizational goals.

2. How can Sage Intacct help CFOs with their changing roles?

Sage Intacct provides the tools needed for CFOs to manage their expanding responsibilities effectively. Its features support collaboration, digital transformation, and strategic decision-making. With real-time financial insights, automated processes, and robust reporting capabilities, Sage Intacct empowers CFOs to focus on strategic tasks, streamline operations, and make informed decisions that drive the company’s success.

3. What is the difference between a controller and a CFO?

While both roles are crucial in financial management, a controller focuses on overseeing the day-to-day accounting operations, ensuring accuracy and compliance. In contrast, a CFO is responsible for the overall financial strategy, including planning, risk management, and strategic initiatives. The controller ensures company’s financial integrity by managing accounting records and processes, while the CFO provides leadership in financial planning, capital structure, and aligning financial goals with the company’s vision.