Finance leaders are concerned about employee retention and recruitment. According to new research from MineralTree’s 9th Annual State of AP Report, when asked about their biggest challenges in AP over the last 12 months, respondents cited the following concerns:

- 20% reported staff turnover

- 14% cited recruitment

- 12% indicated the impact of hybrid/remote work on staff availability

As the role of finance continues to evolve, companies must hire and retain the right people. This blog explores strategies for attracting and retaining finance talent despite an ongoing shortage. It highlights top challenges, the importance of skilled professionals, and actionable steps CFOs can take to build effective finance teams.

Key takeaways

- The accountant shortage is significantly impacting finance teams, making it crucial for organizations to adopt proactive strategies for attracting and retaining top talent. Implementing AP automation can help address this shortage by reducing mundane tasks and allowing AP teams to focus on more strategic work.

- Strong finance teams build trust with stakeholders and improve vendor relationships

- Developing clear career paths and embracing automation can improve employee engagement and retention, leading to more productive finance teams.

An overview of the accounting and finance talent shortage

Many companies are struggling to recruit and retain finance talent due to the accounting shortage. Almost half of CFOs note that burnout and changes in careers for finance professionals are leading to a shortage in talent related to these skills. Research from the 2024 Finance & Accounting Talent Market Outlook shows that 83% of senior leaders reported an accounting shortage, up from 70% in 2022. Almost 90% of survey respondents also noted that the shortage in finance talent prevents teams from delivering on their company’s vision.

Most CFOs also don’t see this shortage in talent improving over the next few years, noting that fewer students are studying finance or accounting at universities. The number of CPA candidates has decreased by almost 50% since 2016, and the average age of a CPA is 53, with most of these employees preparing for retirement in the next 10 years. According to Accounting Today, there could be a deficit of 3.5 million accountants by next year. In fact, nearly 9 out of 10 hiring managers focused on accounting and finance agree that these roles are getting harder to hire for.

Having the right finance team can lead to service delays and missed opportunities for businesses to expand. As a result, it’s important for CFOs and controllers to ensure that they have strategies in place to recruit and retain finance talent.

Why finance talent matters for organizations

Finance teams manage financial operations and contribute significantly to strategic decision-making and overall business growth. Below are three key areas where finance talent makes a big impact:

- Building trust with stakeholders

- Improving vendor relationships

- Data-driven decision-making through analytics

Let’s explore each of these areas in detail to understand the important role finance talent plays within the organization.

Building trust with shareholders

Without a skilled workforce, finance teams are more susceptible to errors that could break the trust of company shareholders. In fact, over 720 companies reported errors in their earning reports due to the accountant shortage.

Improving vendor relationships

A key component of vendor relationships is companies’ ability to pay vendors on time every time. If companies are struggling to fill back office positions and don’t have a fully automated process, they are more susceptible to late payments.

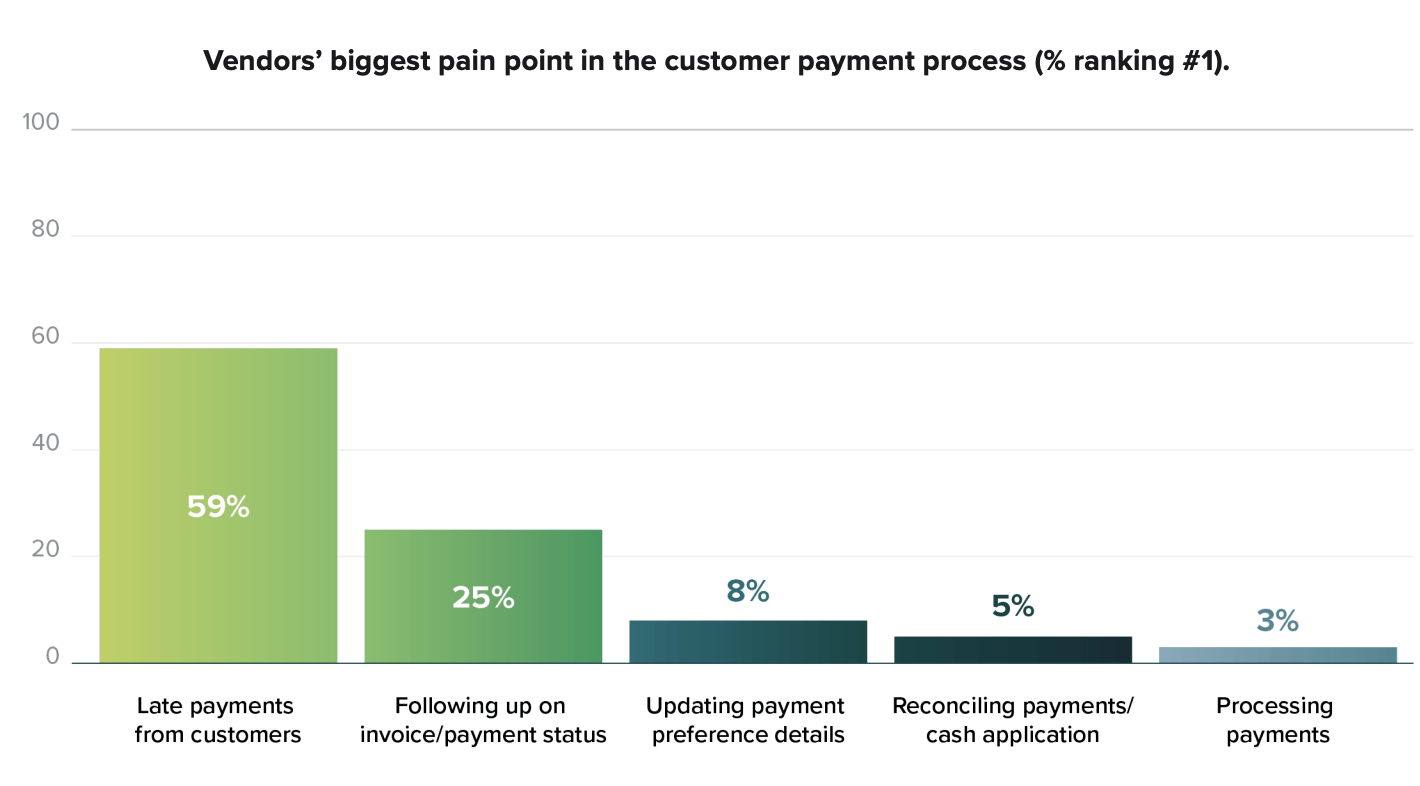

According to research from the State of AP Report, vendors reported late payments from customers as their top pain point:

Data-driven decision-making through analytics

The finance department’s role is shifting to become more strategic. However, without the right people in place, it’s difficult for teams to gather and interpret data for better decision-making. Some finance organizations are actively recruiting candidates from other business or tech-focused career paths in order to upskill them on the job.

The impact of back-to-the-office trends on finance talent

Finance teams have begun heading back to the office, with 57% working primarily onsite (compared to 32% last year). Almost 80% of employers lost talent due to in-office mandates, according to one survey from ResumeBuilder. However, Forbes also notes that “despite the push for RTO, The data does not support the belief that in-person work is more productive.” In fact, 22% of companies surveyed also noted that they do not have metrics in place to measure the success (or lack thereof) of return-to-work policies. However, these same policies can create a sense of f distrust in employers, which can further exacerbate the shortage of talent.

How CFOs can attract and retain talent

CFOs play an important role in attracting and retaining top finance talent. Below are seven key strategies that executives can implement to build and maintain a strong finance team:

- Embrace automation

- Upskill the current workforce and create alternative career paths

- Focus on adding value to the organization

- Incentivize employees based on performance

- Make hiring decisions quickly

- Plan for future workforce needs

- Offer flexible work arrangements

Let’s explore each of these steps in more detail.

1. Embrace automation

Automation reduces the number of redundant tasks, allowing employees to focus on more meaningful work. So it’s no surprise that in the back office, accounts payable remains the #1 automation priority for the fourth consecutive year, according to the State of AP Report. Most teams who embrace AP automation are able to process more or the same amount of invoices with the same size team. Fifty-one percent of those who have automated their processes are using it to address inefficiencies, which is particularly important in relation to staffing challenges. With the shortage of finance talent available, CFOs must have employees focus on the most important work instead of tedious tasks.

However, despite the fact that 4 in 5 finance professionals say more automation is essential, only 19% have fully automated their AP processes.

2. Upskill the current workforce and create career paths

New skills are becoming increasingly important in finance, especially with the increasing focus on digital transformation. Finance teams need new skills to help the organization make better decisions. Digital transformation also gives companies the chance to create exciting career paths to help future-proof their finance team. Finance leaders can also actively recruit entry-level candidates from other fields (e.g., business, technology, or pre-med) to expand the talent pool and invest more resources in on-the-job training.

In fact, 94% of employees agree that they’ll leave a company if their organization is no longer invested in their growth. Compelling career paths help employees envision a future at the company and will, therefore, lead to increased productivity and performance.

3. Focus on adding value to the organization

Meredith Sommers, a news writer for MIT Sloan, recommends shifting from an audit-based mindset to one focused on strategy. She writes that “ideally, when a business is trying to make a decision, it should look to the CFO and financial team as advisers who understand the intricacies, risks, and potential returns of that decision. Doing so not only builds trust across the organization but can start to shift that audit-focused mindset held by many accountants.”

This shift to more interesting work can help employees be engaged. In fact, one out of every two employees who leave their current role is looking for work that is more interesting or more senior. Only 23% leave their jobs for more money.

4. Incentivize employees based on performance

Employee recognition can be an afterthought in a busy work environment. However, for high-performers, companies need to create incentives for them to stay. Only 33% of workers strongly agree when asked if they got recognition for good work they’ve completed in the last week. Additionally, professionals who don’t feel that their work is receiving any recognition are two times more likely to be looking for a new job within the next year.

5. Make hiring decisions quickly

Companies need to take a streamlined approach to hiring finance talent, especially since the pool of applicants is growing smaller. About 50% of those surveyed noted their biggest challenge was making decisions quickly enough to attract the best candidates.

6. Plan for future workforce needs

Boston Consulting Group recommends that CFOs start planning their workforce needs further in advance (3-4 years, if possible). Forward-thinking finance teams and CFOs consider what skills need to be developed within the department and which skills will need to be hired. By looking ahead, CFOs can prepare their companies for changes in the market with the best people possible.

7. Offer flexible work arrangements

Back-to-office mandates are having an impact on finance employee retention and recruitment. CFOs need to find a balance between in-person collaboration and the flexibility employees have been allotted over the last few years. As Forbes noted, back-to-work mandates “often lead to friction between employers and employees, largely because employees have grown used to the benefits of remote work.” Striking the right balance between these two pillars can help companies stand out from the rest of the competition by recruiting from the same talent pool.

How controllers can retain finance talent

Controllers see changes in their roles, with 40% of controllers noting that their roles will further focus on value creation. This shift gives controllers the opportunity to lead their departments, as they embark on new and interesting challenges. While controllers should also focus on automation and upskilling, below are some additional ways controllers can retain talent:

- Future-proof the finance team

- Focus on analytics and value

Let’s explore these in more detail below.

1. Future-proof the back office finance team

The role of finance is changing within the organization, so it’s important for controllers to future-proof the team. With an increased focus on providing value, it’s important for controllers to adopt automation and focus on analytics skills within their departments. Controllers should consider what skills they need for teams to be successful and upskill the current workforce to address those changing needs.

2. Focus on analytics and value

The Wall Street Journal noted that “in the absence of a chief data officer, the controller is strategically positioned to oversee the collection, organization, analysis, and governance of financial data to provide the information needed to support critical decisions.” This new focus on value creation can provide existing employees with interesting opportunities for career advancement, development, and growth. These compelling career opportunities are crucial in retaining valuable employees.

Final thoughts

Finance talent is increasingly difficult to attract and retain. However, by implementing a strategy in place, CFOs and controllers can retain their current workforce while attracting the best people possible to fill open positions. Embracing automation allows finance teams to focus on more meaningful tasks, helping to keep them engaged and create compelling career paths. To learn how MineralTree can help, request a demo today.

FAQs on retaining and attracting finance talent

Tl;dr? If you’re short on time, the frequently asked questions below provide a quick snapshot of what you need to know about retaining and attracting finance talent.

1. Is finding finance talent getting harder?

Due to factors such as the accountant shortage, finding the right finance talent is becoming more difficult. Additionally, since the role of finance is becoming more strategic, CFOs are often looking for new skills in their teams.

2. Is there a shortage of finance professionals?

There is a shortage of finance professionals, with the number of CPA candidates decreasing by almost 50% since 2016.

3. How can automation specifically help in reducing employee turnover?

Automation can reduce employee turnover since finance professionals have more time to perform more meaningful work. The reduction in menial tasks can also help CFOs and controllers craft more compelling career paths for their employees.

4. How does automation help improve work/life balance for finance professionals?

Automation can help eliminate time-consuming and burdensome tasks. As a result, finance professionals can focus their energies on more compelling work, while reducing the long hours associated with these cumbersome tasks.

5. What trends should CFOs watch for in the future of finance talent management?

Data analytics is becoming increasingly important for CFOs and their teams. Executives and CEOs are looking to CFOs for more strategic direction and insights into the decision-making process. CFOs should consider hiring for these abilities while upskilling their workforce.