The Current State of Finance

There’s no debating that the COVID-19 pandemic has shifted how companies operate. Faced with staff cuts, the Great Resignation, and supply chain issues, executive teams must now carefully strategize how to propel their companies in the right direction. So where are they setting their focus in the new year? According to data from Gartner, the top three most difficult tasks for CFOs to manage in 2023 include: hiring and retaining staff (54%); forecasting (36%); and cutting the right costs (35%). While these three areas are top of mind for finance leaders, they represent just a fraction of the challenges facing teams as they prepare for the future. Keep reading to learn more about the different types of obstacles standing in the way of today’s finance departments.

Staffing Issues

According to a survey by PWC, about one out of five employees planned to change jobs in 2022. Unfortunately, back-office positions such as accounts payable tend to be lower on the hiring priority list when it comes to backfilling roles. However, invoice payments still need to be made if business is to continue as usual, so AP teams must find alternative solutions to maintain their output levels even when understaffed.

With the high turnover rates in 2022, automation tools are a valuable asset for teams to ensure that payment operations run smoothly amidst changing staff. MineralTree’s 2022 State of AP report also highlights the current challenges around finance staffing, with 54.3% of survey respondents reporting that they expected challenges or delays in hiring quality AP staff this year.

Cash Forecasting

The pandemic expedited the strategic role that finance has taken on over the last few years. Market instability and uncertainty caused by the COVID-19 pandemic has made accurate financial forecasting and visibility more crucial than ever for organizations around the world. Many teams today are working to improve their visibility and analytics to make their cash forecasting more accurate.

Vendor Relationships

The pandemic has disrupted supply chains, making businesses more reliant on their vendors. As a result, nearly 71% of finance professionals reported that their vendor relationships grew in importance over the past year, compared to just 58.5% in 2021. For markets such as healthcare, this number is even higher. For businesses to run, it’s important to prioritize these relationships. Unfortunately, supply chain disruptions create invoice processing delays amongst AP teams, jeopardizing timely vendor payments (the #1 concern of vendors).

Team Skill Sets & Internal Cultural Shifts

18% of CFO’s surveyed by Gartner reported that “achieving outcomes on digital investments” will be one of the most difficult tasks over the next year. Beyond managing the technological logistics of digital transformation projects, CFO’s must oversee a cultural shift within their finance organizations wherein teams adjust to and accept the new strategic focus of finance – as opposed to its traditional and tactical focus areas. This culture shift is key to the long-term success and adoption of digital transformation projects within any organization. Deloitte writes that “technology without talent can fail, but talent with leadership direction can overcome technology shortfalls.” In short, teams can’t achieve digital transformation without buy-in from their internal team and leadership.

The Future of Finance

As the role of finance continues to shift, there are several themes that teams should embrace to remain agile and modern. Below are 5 key areas to focus on to future-proof your team:

More Strategic & Less Reactive

Today’s finance departments can inform greater company strategy, so long as they have the right analytics, visibility, and comprehensive business understanding to identify opportunities and risks.

When AP teams are not bogged down with manual tasks, they can work on more strategic projects like improving supplier relationships or optimizing their payment mix. For example, Quartzy, a life science product distributor, is on track to earn $100,000 in rebates by taking advantage of virtual cards. Vendors such as MineralTree can help companies enroll their strategic suppliers in electronic payment methods, so they can reap the benefits of ePayments without the added work to switch vendors over to the new method.

Digital Transformation

Digital transformation will take the lead for companies looking to operate more efficiently with the same size staff. But companies can’t keep treating issues one-by-one like they exist in a vacuum. In order to achieve a successful digital transformation strategy, CFOs and other finance leaders must work together to understand how key challenges facing finance departments relate to each other. From there, they can work to build a holistic digital transformation strategy that tackles several issues simultaneously.

More Data-Centric

As CFOs unlock better data and financial insights, their perspective and strategy will become increasingly important within the C-suite. This shift depends on the successful implementation and management of technologies like artificial intelligence and predictive analytics that enable financial insights in the first place. Ultimately, this is all dependent upon the talent and skill set of the people hired in and leading those areas.

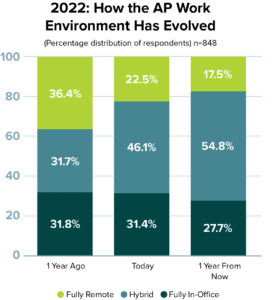

Remote and Hybrid Teams

As the rate of remote and hybrid teams continues to grow, most teams are not in the office for five days a week. In fact, only 31.4% of teams recently surveyed are in the office full-time and only 27.7% expect to be in the office every day next year. As this shift continues, it’s important that finance teams embrace processes that are conducive to doing business online. Else, they risk losing their competitive edge due to increased inefficiencies.

Uncertain Economic Future

Many companies are bracing for a recession in 2023. As the economic future remains uncertain in the wake of the pandemic, businesses will focus on improving their operational efficiencies to future-proof their teams, while saving money.

How Finance Can Prepare: 4 Ways to Future Proof Your Team

As roles in finance shift, executives and department leads can help their teams in the following ways:

1. Invest in Automation

Only 26% of employees work at an organization that uses automation or technology to improve the work experience. This highlights a large opportunity for teams to embrace finance automation and maximize the value of their team. By delivering increased operational efficiencies and productivity levels from staff, finance automation tools make it simple for teams to tackle both staffing and budget issues. Companies that embrace automation also provide a better work experience for their employees, making it easier to keep current employees happy and recruit new talent.

2. Focus on Organizational Change Management and Support Staff Amidst Changes

According to PWC, only 40% of employees reported that their employers had invested in upskilling and 39% are concerned that their companies were not providing them with the digital training they need. As firms automate more financial processes, it’s important to consider how internal roles must shift to ensure that teams continue to be productive.

Business leaders should support internal team members with a detailed organizational change management plan. By proactively communicating any upcoming changes with staff, employees will then be more open and accepting of new systems. This ultimately leads to higher and faster adoption rates for new technology tools, expediting a project’s success.

3. Invest in Analytics and Ensure Data is Accurate

Accurate data is the foundation of any organization’s success. If finance can’t provide accurate, up-to-date data then CEOs will look elsewhere for advice. While technology is available to help finance deliver, many teams have yet to take advantage of its power. Rather than exploring new cutting-edge technology, most finance teams who made automation gains during the COVID pandemic did so out of necessity to support their hybrid and remote teams to keep their functions running. As a result, there remains huge opportunities for today’s finance teams to up their data analytics game in 2023 and beyond.

The AP and AR functions remain vital sources for incoming data, since they track the earnings and liabilities of a company. However, many AP teams can only use their invoice data once it’s been posted to the ERP and some teams may lack visibility into their payment processes. Since AP data plays a vital role in accurate cash forecasting and in cash flow management, this gap can cause issues for organizations looking to be more strategic.

Good data requires detailed and thoughtful organizational changes, and guidance from leadership teams. Reworking and organizing finance databases are never easy, and everyone must be onboard in order to ensure and expedite success. According to Deloitte, “data issues won’t be solved by technology alone. Fixing them requires a Finance-led discussion on the right data foundation.”

4. Be Vigilant Against Fraud

More regulations aimed at combating fraud are on the horizon. Although these laws will work on preventing invoice fraud we know today, finance teams must remain vigilant. Hybrid and remote teams have opened communication gaps, making it easier for fraudsters to slip through the cracks. Scammers will also continue to find new ways to fool people, making it important for teams to proof invoice and vendor information. By partnering with an automation solution, teams can reduce human error and automatically flag suspicious invoices for review.

Case Study: How Simple Mills is Using Automation to Future-Proof Its Team

Simple Mills is a leading provider of snacks with clean and nutritious ingredients. Previously they relied on a single person for their invoice processing. Their outdated system created several issues and inefficiencies for the organization. But now with MineralTree, Simple Mills supports their employees with state-of-the-art finance technology. The switch to an AP automation solution grants them more visibility into the payment process, while allowing their team to scale the business. They were also able to leverage AP analytics to make better business decisions. By analyzing the spend-by-vendor capability, they can now model different business case scenarios such as extending payment terms and early-pay discounts, to optimize their payment mix.

Final Thoughts

The role of finance is changing, with teams taking a more strategic role in shaping their company’s future. For companies looking to future-proof their financial department, it’s important to automate manual tasks to improve efficiency and resources. With an AP automation tool like MineralTree, your team can begin the process of digitizing the financial function, while improving data accuracy and analytics capabilities. To learn more, schedule a demo today.

Frequently Asked Questions

How will roles in finance change?

In the future, teams will continue to focus more on optimizing their efficiencies so that AP staff is less tied up in manual tasks, and can instead focus on managing and strategizing. Roles will become more strategic, and based in AP analytics, as opposed to overly manual and redundant. Many experts predict that to reduce its reliance on IT, finance teams will soon start to hire more people who can configure and customize digital tools to generate insights.

How can MineralTree help prepare teams for the future?

- Reduce costs – AP teams can reduce total cost per invoice by up to 430% with end-to-end AP Automation.

- Improve Visibility & Retain Control – Eliminating paper-based processes and managing AP from a central platform accessible anywhere provides better visibility across user roles, business units, and locations. Real-time analytics provide insights and help you maintain better control over spend.

- Reduce Payment Costs & Generate Cash – Leverage MineralTree’s supplier network to reduce payment costs and maximize cost savings, security, and cash-back rebates by converting paper checks into virtual card and other ePayments.

- Enhance Security & Mitigate Fraud Risk – Nobody wants to be the next headline. Mitigate external and internal risk by maximizing ePayments, creating a clean audit trail, offloading management of vendor payment details, and using best-in-class security controls.

- Upskill Your Team – MineralTree automates tedious, redundant tasks for AP teams so that AP staff can invest their time in more strategic projects and upskilling their talents according to company goals.

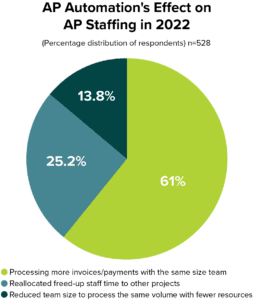

- Increase Efficiencies – Teams with AP automation unlock tremendous efficiency gains. According to our 2022 State of AP report, 61% of teams with AP automation are able to process more invoices with the same size team, while 25% chose to reallocate freed-up staff time to other projects. Lastly, 13.8% of AP teams with automation chose to reduce their team size due to their new efficiency gains.