The importance of managing foreign exchange risk

In today’s global economy, companies of all sizes rely on international transactions for crucial business operations. Whether a business sources materials from overseas or pays an international contractor, it must manage cross-border payments while preparing for market changes that can threaten profitability. In particular, foreign exchange risk resulting from shifting currency rates can stress cash flow, cost management, and vendor relationships.

Businesses need proactive strategies to mitigate the effects of currency fluctuations and effectively protect against foreign exchange risk. Strategic planning and an effective AP automation solution can help companies streamline international transactions and maintain financial stability.

This blog explores the benefits of effective currency risk management, the different types of foreign exchange risk, and actionable strategies for protecting your company from currency fluctuations.

Key takeaways

- Foreign exchange risk is the potential impact of currency rate fluctuations on a business’ financial outcomes.

- Businesses should implement strategies to manage foreign exchange risk, like avoiding intermediary fees and securing favorable exchange rates through strategic contract negotiations.

- An AP automation solution like MineralTree can streamline the international payment process to enhance cash flow, cost management, and forecasting.

What is foreign exchange risk?

Foreign exchange risk, or currency exchange risk, refers to financial losses businesses can face due to fluctuating currency exchange rates. These fluctuations can affect the cost of goods or services purchased from a foreign country, the value of international investments, or any transactions involving foreign exchange payments–ultimately impacting a business’ overall cash flow and profitability.

Companies that conduct international business should prepare to manage foreign currency volatility. Various strategies, like carefully negotiating contracts and securing favorable exchange rates, can help companies execute more seamless international payments, enabling better financial planning and management.

Benefits of currency risk management

Currency risk management is the process of mitigating financial risks from currency rate changes. Effectively managing this risk can provide significant advantages for businesses, including:

- Control costs

- Limit liabilities

- Better cash flow management

- Improved forecasting

Let’s explore each benefit in more detail below.

Control costs

As currency rates fluctuate, so can the cost of goods and services purchased from abroad, resulting in unexpected expenses. For example, imagine an American company that engages a German company for an ongoing service at the cost of €100 per month. When the contract starts, the exchange rate is even at $1 = €1, so the American company pays $100 per month. However, over time, the balance shifts, so that $0.75 = €1. Now, the American company is paying $133.33 a month, more than they budgeted for. Effective currency risk management allows companies to minimize these effects for more predictable cost management.

Did you know? An AP automation solution like MineralTree can help lock in favorable exchange rates by facilitating timely payments, ensuring businesses avoid unexpected cost increases.

Limit liabilities

Unnecessary liabilities can strain a business’ cash flow and profitability. Foreign exchange fluctuations can often increase liabilities, causing a business to owe more to vendors than planned.

For example, if a business anticipates paying a vendor $100 per month but ends up owing $133.33 per month due to exchange rate changes, its liability is greater. Currency risk management helps reduce these cost changes so businesses can lessen unexpected budgetary pressure and execute timely payments, providing a sense of security and control.

Did you know? Businesses can ensure timely payments by automating payment processes with AP automation, reducing the risk of increased liabilities due to fluctuating rates.

Improve cash flow management

Currency risk management reduces uncertainty around how much businesses will owe in international payments. This supports better cash flow management by giving businesses a more accurate picture of upcoming expenses.

Did you know? An AP automation solution like MineralTree can provide up-to-the-minute visibility into cash flow so companies can plan for future expenses more accurately.

Improved forecasting

By mitigating unexpected cost changes from currency fluctuations, businesses can better forecast their cash inflows and outflows. This enables stronger long-term financial planning and budgeting, with less concern that global market volatility will impact the business’ bottom line, instilling a sense of confidence and preparedness.

Did you know? AP automation can help create detailed forecasts that account for potential currency shifts, allowing for proactive budgeting and financial planning. This enhances the overall financial strategy and helps companies make informed decisions regarding pricing, vendor negotiations, and cash flow management.

Types of foreign exchange risk

Foreign exchange risk involves three main types of risk—transaction risk, translation risk, and economic risk—that each brings different challenges for businesses to navigate.

- Transaction risk

- Translation risk

- Economic risk

Let’s take a closer look at the primary risks below.

1. Transaction risk

Transaction risk occurs when businesses purchase goods and services from foreign countries. As exchange rates fluctuate, companies can face unexpected financial losses if currency values change between the time of an initial agreement and when payment is made.

For example, imagine a company in the US purchasing a shipment of goods from a company in France. The price is denominated in euros, and payment is due upon delivery. If the euro appreciates against the U.S. dollar by the time the goods are delivered, the US company will have to pay more than anticipated to match the agreed-upon price.

Automating payment processes using AP automation software can help companies lock in exchange rates at the time of the transaction, protecting against rate changes before payment is made.

2. Translation risk

Translation risk is an issue for companies with international assets and operations. If a multinational company has a subsidiary operating in a foreign currency, the subsidiary’s financials will be translated to the parent company’s home currency for reporting. In turn, exchange rates can impact a company’s broader financial metrics, like income and asset values.

Automation can help streamline the consolidation of financial data from international subsidiaries, providing accurate currency conversions and improving reporting. This gives companies a more comprehensive view of their overall financial health, allowing them to respond quickly to currency fluctuations and make more informed decisions.

3. Economic risk

Economic risk refers to the continuous impact of exchange rate fluctuations on a company’s market value. When operating in international markets, businesses need to be aware of how changes in currency value can impact their cash flow and profitability. While economic risk can be challenging to predict, various strategies can help businesses navigate uncertainty in the global economy.

AP automation can help companies quickly adapt to market changes by providing insights that inform pricing and strategy adjustments in response to currency fluctuations.

5 ways to protect your company from currency exchange risk

Establishing a plan to navigate international currency fluctuations helps businesses avoid unexpected costs and financial disruptions. Here are five strategies for managing foreign exchange risk:

- Pay vendors in US dollars (USD)

- Contract negotiations

- Limit moving exchange rates

- Eliminate intermediary and foreign transaction fees

- Forecasting

1. Pay vendors in US dollars

When possible, making international payments in USD can eliminate last-minute cost changes based on currency rates. This helps your business know the precise amount owed to a vendor for better financial planning and stability.

Still, it’s important to remember that payment in USD may be an issue for some international vendors. During payment term negotiations, weigh your ideal payment currency with the need to maintain strong vendor relationships. If vendors do not accept payment in USD, implementing an AP solution that supports multi-currency payments can minimize processing challenges. AP automation solutions can facilitate multi-currency transactions, making it easier to negotiate better payment terms.

2. Contract negotiations

During contract negotiations, companies can set specific terms to mitigate foreign exchange risk.

For example, a forward contract allows businesses to privately negotiate an exchange rate for future transactions with a bank or financial institution. Future contracts operate similarly, except they are traded on exchanges and have standardized terms, providing slightly less flexibility and customization.

Businesses can also write currency clauses into their contracts—for example, a clause specifying payments will be made in USD. Or, a contract could contain a currency risk-sharing clause that outlines how parties will split any financial losses resulting from exchange rate changes.

Whichever contract tactics you choose, strategic negotiation in advance can help you insulate your business from the impact of sudden changes in exchange rates.

Did you know? AP automation software can help track contracts and alert companies about upcoming payment dates, ensuring you can capitalize on favorable exchange rates.

3. Limit moving exchange rates

Exchange rates fluctuate based on broader economic factors. To protect themselves from sudden changes, banks typically set a daily exchange rate for international payments. Businesses that rely on banks for international payments have to agree to this rate, even if it’s more favorable for the bank.

To avoid getting stuck with a bank’s daily fixed rate, businesses can use a payment solution that offers more flexibility. Some payment solutions allow businesses to “lock in” on real-time exchange rates when they initiate a transaction, enabling greater control and cost management.

Did you know? MineralTree’s exchange rates continuously refresh to reflect real-time currency changes so businesses can take advantage of the best rates.

4. Eliminate intermediary and foreign transaction fees

Intermediary banks typically charge fees to process international transactions. While intermediary fees are not directly related to currency fluctuations, the additional cost can reduce the amount sent to the vendor, leading to incomplete payments.

Payments made at a later date will also likely be subject to a different exchange rate, creating extra challenges for accurate cash forecasting in relation to accounts payable. Additionally, if payments are incomplete, companies may also need to pay foreign transaction fees twice.

Risks related to incomplete payments are also a key concern for supplier relationships. Eliminating intermediary fees ensures payments are made in full to strengthen vendor relationships and streamline cross-border transactions.

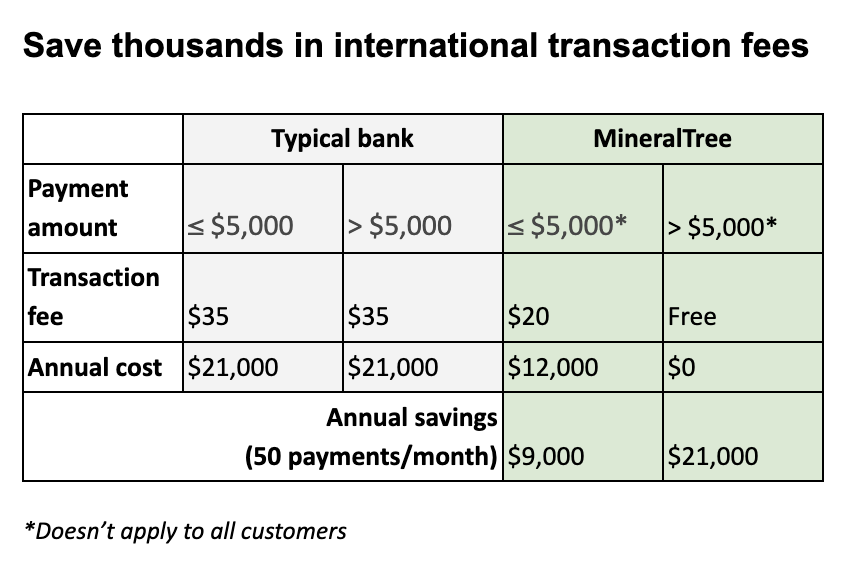

Did you know? MineralTree eliminates intermediary fees for international transactions so businesses can pay vendors accurately while avoiding added costs. MineralTree also offers lower transaction fees, further reducing costs related to international payments.

5. Forecasting

Businesses should analyze their historical financial data to improve their ability to handle future international transactions. Assessing how currency fluctuations have previously impacted specific business operations helps companies predict future expenses more accurately and make adjustments to protect their bottom line.

An AP analytics tool supports accurate forecasting by providing visibility into key metrics like payment history and reconciliation for international transactions. In turn, a business might determine that negotiating new vendor terms or eliminating intermediary fees can help reduce costs and improve payment accuracy going forward.

Navigating currency risks with confidence

Every company that conducts businesses internationally should be ready to manage the challenges of foreign exchange risk. Without effective strategies in place, fluctuating currency rates can lead to unexpected costs, impacting cash flow and preventing accurate forecasting.

MineralTree’s AP automation solution helps businesses take control of their international transactions. By eliminating intermediary fees and locking in favorable real-time exchange rates, businesses can maximize control and predictability in their cross-border payments.

Contact MineralTree to learn how an AP automation solution can support your foreign exchange payments.

Currency exchange risk FAQs

Tl;dr? If you’re short on time the frequently asked questions below provide a quick snapshot of what companies need to know about foreign exchange risk.

1. What causes foreign exchange risk?

Foreign exchange risk is caused by constant fluctuations in global currency. As exchange rates shift due to factors like inflation and geopolitical events, businesses making international transactions can be at risk of financial losses.

2. What is hedging?

Hedging is a strategy for companies to minimize foreign exchange risk by locking in exchange rates for future transactions. Businesses can utilize forward contracts, future contracts, options, or similar methods to protect against currency fluctuations.

3. What is the difference between a spot rate and a forward rate?

Spot rates and forward rates are both rates for currency exchange, but apply to different types of transactions. A spot rate reflects the current exchange rate for immediate transactions. In comparison, a forward rate is a pre-determined exchange rate for a future transaction.

4. What software solutions are available for managing foreign exchange risk?

Various software solutions, including AP automation tools and financial analytics platforms, are designed to help businesses monitor and manage currency fluctuations effectively.

5. Can AP automation help in managing compliance with international financial regulations?

Yes, AP automation can facilitate compliance by maintaining accurate records, providing audit trails, and ensuring that transactions are conducted in accordance with relevant regulations in different jurisdictions.

6. What are the benefits of locking in exchange rates for future transactions?

Locking in exchange rates through tools like forward contracts can protect businesses from unfavorable currency movements, ensure predictability in costs, and help stabilize cash flow.

7. What are some common strategies to mitigate translation risk?

To mitigate translation risk, AP automation software can help businesses ensure accurate real-time currency conversions, streamline data consolidation, and maintain updated records. Developing robust accounting policies that account for currency fluctuations is also essential.

8. Are there specific features in AP automation that help with forecasting?

Yes, many AP automation solutions offer analytics tools that analyze historical data and provide insights into currency trends, helping businesses make more informed decisions about future expenses and cash flow management.