Have you ever considered how much cash your organization is handing over just to pay the bills? Every functioning part of a business incurs a cost — including accounts payable (AP) and the process of paying invoices. So how can you get a grip on this critical type of spending? By calculating your business’s AP cost per invoice. Keep reading to learn how.

Key takeaways

- Calculating the cost per invoice in AP includes totaling the number of invoices paid by all the costs incurred to pay them.

- Labor, software, overhead, and training costs are all areas that must be calculated to understand the cost per invoice for your business.

- Switching to an automated AP process and phasing out check payments can help your business significantly reduce labor and infrastructure costs, ultimately lowering the cost per invoice.

What does cost per invoice in accounts payable mean?

Cost per invoice in accounts payable refers to the amount of money spent to process a supplier invoice from start to finish. Calculating the cost per invoice can help businesses identify areas of improvement. For instance, a higher cost per invoice might indicate inefficiencies in the AP process, like human error from manual tasks.

What’s the formula for calculating cost per invoice?

The formula for calculating the cost per invoice is as follows:

Cost per invoice = Total accounts payable processing costs ÷ total number of invoices processed

Total accounts payable processing costs include any cost associated with processing invoices, including labor costs, overhead costs, software costs, or any other expenses incurred from the AP process. The total number of invoices processed refers to the total number of invoices that were sent through processing within a certain period of time – can be a year or even a month.

What to include when calculating the cost per invoice in AP?

To accurately calculate the cost per invoice for your business, you must have insight into the following metrics:

- Labor costs: This includes salaries and benefits of full-time and part-time employees within the accounts payable department.

- Software costs: This includes any amount spent on software, IT infrastructure, etc used within the AP process.

- Overhead costs: Calculate indirect costs within the AP process including rent, office supplies, utilities, etc.

- Training and development: This includes any costs associated with training staff and AP processes, how to use the software, as well as how to maintain compliance.

- Miscellaneous costs: Any additional costs incurred by the accounts payable department including late payments, missed early payment discounts, etc.

How do you calculate the cost of an invoice in accounts payable

The total number of invoices paid (for a set time period) divided by all the costs incurred to pay them (for that same time period) will give you the AP cost per invoice. This metric, along with other accounts payable metrics, provides an accurate measure of a business’s AP efficiency.

What should your AP cost per invoice look like? It’s hard to say, as it varies widely across industries. Take a look at these estimates from IOFM:

- For low invoice volume (<20,000) organizations, the average cost to process a single invoice is $12.98 with automation and $15.97 without automation.

- For moderate invoice volume (20,000 – 100,000) organizations, the average cost to process a single invoice is $4.24 with automation and $6.10 without automation.

- For high-volume accounts payable (>100,000) organizations, the average cost to process a single invoice is $3.18 with automation and $3.62 without.

Consider the difference between paying $3 per invoice and $16 per invoice with 200 invoices to process per month.

Clearly the gap in these two scenarios is massive, with a difference of $31,200 per year. What would it mean to your company to have that much extra cash? Improved cash flow, better financial statements, and the ability to reinvest in strategic activities are all on the table.

If you don’t know where your business falls in this range, it’s time to gain some visibility by calculating the AP cost per invoice. You’ll need a handful of inputs to get started.

Labor costs

Labor costs include the cost of employee time to process invoices. They are the most time-consuming and complex costs to calculate, so start there first.

To understand labor costs, you’ll need to determine which employees perform invoice processing. Expect at least three people to be included: the employee who enters the payment details, the approver, and the employee who releases the funds.

Once you’ve determined the appropriate employees, it’s time to calculate an hourly rate. Here you can take one of two approaches: if there’s a close salary range across AP employees, you might create an average monthly salary divided by 160 hours. If there’s a big discrepancy in individual salaries, consider calculating the hourly rate per AP employee.

Last, you’ll need to know how much time each AP team member spends on invoice processing. This data may be easy to gather if your staff is already using a time-tracking tool. If not, breaking invoice processing tasks down and having employees track time over a set period will provide an accurate picture. Data included in your assessment will likely be:

- Communicating with new vendors to discuss invoicing processes and payment methods.

- Receiving the invoice from the vendor and entering it into the accounting system of record.

- Performing fraud- or error-reducing steps like 2–way matching prior to payment.

- Generating the payment for the invoice and sending it through approval.

- Approving the payment to be sent to the vendor.

- Releasing the funds for payment.

- Dealing with any exceptions in the process including erroneous and late payments.

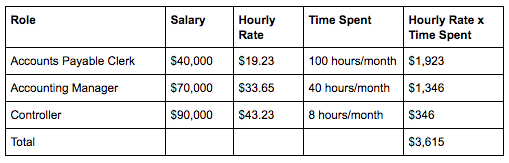

You’re equipped to start calculating AP labor costs for invoice processing. Here’s a sample data set to give you the idea:

**As you gather up all the data, make sure you use the same time period for each input. A 30-day window is a great place to start given that many of the inputs are already measured that way — making your work easier.

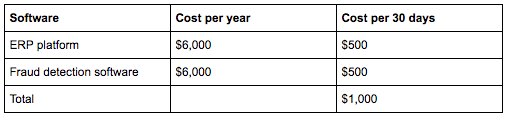

Infrastructure costs

The next piece of our puzzle is infrastructure costs, which cover the cost of any software platforms your business uses to manage invoice processing. An enterprise resource planning (ERP) platform, fraud detection tools, and payment processors are a few key examples. Find out how much your business pays for each applicable tool and divide by the appropriate time period. For tools that are used by multiple groups in the company (like an ERP), you can further refine the cost by determining what portion of the tool the AP department is financially responsible for.

Physical goods costs

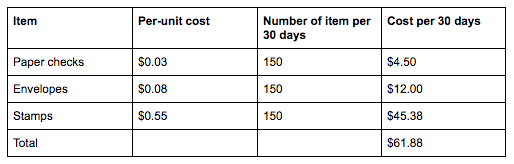

Next up are the costs associated with physical goods. You might think there aren’t any physical goods connected to invoice processing. However, if your business is still using paper checks for any portion of payments, there are tangible goods involved that incur real costs.

Physical goods include the fees paid to purchase paper, envelopes, ink cartridges, and stamps to print and mail checks. And don’t forget about the cost of the printer and printer maintenance. Like the cost of an ERP, the sunk cost of a printer and printer maintenance fees can be split out as a portion of the entire company’s usage.

Let’s assume for this example that a business pays 200 invoices per month and three-quarters of those invoices are paid with a paper check.

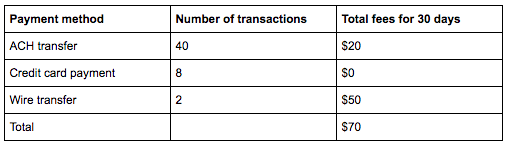

Transaction fees

Last on our list are transaction fees. If our sample company pays 200 invoices per month and 150 are paid by paper check, the rest are likely paid using electronic methods of payment. ACH transfers, eChecks, credit card payments, and wire transfers all generally include a per-transaction fee (either fixed or variable). These fees should be easy to access by pulling a summary report of all transactions (and associated fees) for a 30-day period.

Armed with a wealth of data, it’s time to put it all together and calculate your AP cost per invoice. Fill in the inputs for the following calculation:

(Total labor costs + total infrastructure costs + total physical goods costs + total transaction fees)/Total number of invoices per 30 days = AP cost per invoice

Here’s how our sample company fared:

($3,615 + $1,000 + $61.88 + $70)/200 = $23.73 AP cost per invoice

Regardless of where your business lands, going through this exercise gives you an opportunity to make informed decisions. Now that you know the real costs that go into paying invoices, you can take steps to reduce them.

If you’re wondering how companies can keep their AP cost per invoice as low as $2 per invoice, here are some best practices that can increase efficiency and drive down expense:

- Labor costs, the greatest source of cost in the process, could be curtailed by replacing manual AP processes with automation to drastically limit the number of hours required for invoice processing.

- Infrastructure costs could be decreased by evaluating AP functions and combining them into one lower-cost platform.

- Physical goods costs may be eliminated by phasing out check payments in favor of electronic payment methods.

- Transaction fees could be scaled down by evaluating each payment method and determining which vendors accept lower-cost forms of payment that can potentially earn you cash-back rebates, like virtual cards.

Final thoughts

Calculating and lowering your AP cost per invoice can feel overwhelming with factors like labor costs, infrastructure costs, physical goods costs, and transaction fees playing in. However, by incorporating best practices, like switching to an automated AP process and phasing out check payments, you can significantly cut down on labor and infrastructure costs. With one lower-cost platform that automates manual tasks, you can rest assured that invoices will be paid in a timely and accurate manner and costs will remain low.

Are you interested in understanding more about how automation can drive down your AP cost per invoice? Use our ROI calculator for a customized report on your business’s estimated savings with AP automation.

Cost per invoice FAQs

How do you calculate accounts payable on a balance sheet?

To calculate accounts payable costs within your business, start with the beginning balance of accounts payable for the accounting period. Then, add all outstanding invoices awaiting payment and deduct any payments already made.

What is accounts payable on a balance sheet?

Accounts payable is listed on a company’s balance sheet within the category, “current liabilities”, as it represents the funds owed to creditors. Current liabilities usually include short-term financial obligations, typically spanning less than 90 days.

What is included in an accounts payable invoice?

An accounts payable invoice typically includes invoice number, date, payment deadline, vendor information, buyer information, description of goods and services, invoice total, payment terms, and more.

What does it cost to process an invoice?

For low invoice volume (<20,000) organizations, the average cost to process a single invoice is $12.98 with automation and $15.97 without automation.