Not too long ago, invoices traveled from desk to desk in paper form. Processing them required manual approval by each reviewer, the signing and mailing of physical checks, and long, tedious paper trails. Even today, many AP departments still rely on a combination of paper and technology that is less than ideal.

But modern business’s speed and sophistication drive digital transformation across all parts of the enterprise, including accounts payable and other back office functions.

As businesses look to streamline, simplify, and scale financial management processes, more teams are moving to highly efficient, entirely paperless AP processes. Sage Intacct (like many other ERP systems) enables businesses to go paperless—but migrating effectively requires a clear understanding of the challenges, opportunities, and technologies impacting AP teams in the digital realm.

Key takeaways

- Modern ERP systems such as Sage Intacct enable companies to streamline, simplify, and scale financial management operations.

- Without the right technology tools and practices, businesses often struggle to transition to fully paperless AP processes.

- Automating the end-to-end AP process allows businesses to improve accuracy, enhance efficiency, and extract maximum value from their financial management system.

Can accounts payable be paperless?

Paperless payment is not only possible—it’s becoming increasingly popular among accounts payable departments and suppliers.

Paperless AP handles the full invoice-to-pay process electronically without the need for paper or printed items. This transition requires a modern ERP system, such as Sage Intacct, with integrated software to automate, streamline, and support digital workflows in capturing, approving, and managing invoices and payments.

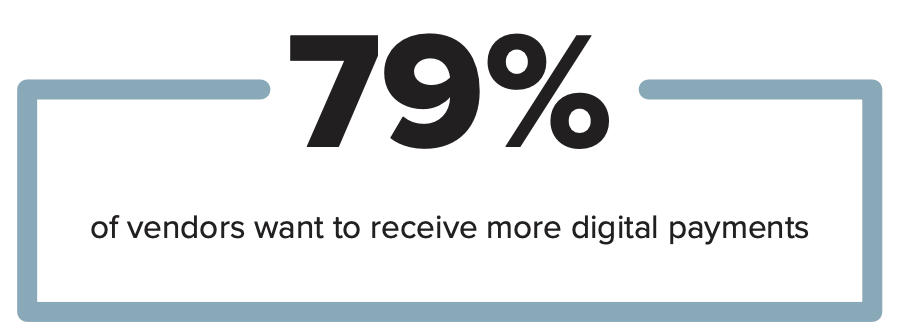

The switch to paperless also requires a level of buy-in from suppliers, including agreements to submit digital invoices and accept electronic payments (ePayments). Fortunately, many suppliers are also eager to gain the efficiency and ease of digitized processes. According to MineralTree’s 8th annual State of AP Report, 79% of vendors want to receive more digital payments.

Challenges of a paperless workflow in Sage Intacct without automation

The transition to a paperless AP workflow within Sage Intacct comes with its own challenges, particularly when automation tools are not in place.

Although more than three-quarters of businesses have implemented some form of automation, many are struggling to scale automated technologies. In fact, most companies do not even have half of their process automated. This can be a significant barrier to achieving a truly paperless AP workflow, given the following challenges in Sage Intact.

1. High amount of complexity

Because Sage Intacct is designed to cater to the broad and diverse needs of organizations across several industries, many of its tools have a high level of complexity and sophistication. That can be a double-edged sword: Although these tools provide functions and features necessary for a wide range of business processes, they can also make transforming AP into a paperless process much more difficult.

To add to the challenge, AP departments are often overlooked when prioritizing functionality upgrades or transformations, which puts teams behind in leveraging the necessary tools to transition to a paperless system.

2. Payment methods

Without AP automation, the process of writing, distributing, and managing paper checks is time-consuming, manual, and prone to mistakes. Because Sage Intacct limits the payment methods that AP teams can use, including integrated support for virtual cards, AP teams need third-party integration or upgrades for certain virtual payment solutions. For instance, Sage Intacct recently announced plans to discontinue support for American Express Card Payment Services. However, MineralTree’s collaboration with Amex allows customers to use their American Express corporate card in AP workflows.

How to go paperless with Sage Intacct

Going paperless with Sage Intacct can be a game changer. However, organizations need the right technology and practices to enable paperless workflows, support teams, and the management of the following processes:

1. Capture invoice data electronically

Transitioning to a paperless system starts with electronic invoice capture, which enables businesses to automatically match invoices to purchase orders and receipts, simplifying the approval process, streamlining the entry process, and reducing errors in the process.

Did you know? While Sage Intacct offers basic invoice capture functionality, MineralTree leverages OCR and human review to achieve up to 99.5% accuracy upon invoice capture.

2. Approve invoices digitally

Digital approval processes further enhance efficiency by simplifying the review and approval of invoices. Customizable approval workflows can be tailored to fit each organization’s unique structure and policies, ensuring invoices are reviewed by the appropriate personnel and reducing bottlenecks that hold up the process.

Did you know? MineralTree allows decision-makers to easily approve invoices from their email, eliminating the need to log in to complicated systems. Although Sage Intacct offers role-based approvals, MineralTree can offer further granularity by introducing different tiers.

3. Invest in electronic payment methods

Embracing electronic payment methods is essential for a paperless AP process. These methods expedite transactions and reduce the reliance on paper checks and the risks associated with mail. Incorporating a variety of payment options, including ACH, virtual cards, and eChecks, can significantly enhance payment efficiency and security.

4. Store documents electronically

Electronic document storage is a cornerstone of a paperless AP system, facilitating easy access to invoices and financial records. This reduces physical storage needs and simplifies auditing accounts and closing month-end books.

Did you know? MineralTree provides unlimited document storage, enabling organizations to access and scale digital solutions easily.

5. Automate the end-to-end accounts payable process

Integrating automation with Sage Intacct transforms AP by automating every part of the process, from invoice capture to payment execution. This alignment allows users to extract maximum value from their financial management system, improving accuracy, efficiency, and strategic insight into the AP process.

Benefits of a paperless workflow with AP automation software

Integrating AP automation with your Sage Intacct instance introduces significant advantages for businesses and their suppliers, paving the way for more efficient, transparent, and collaborative financial processes. Automating accounts payable to support paperless processes helps organizations streamline the AP workflow and gain the following benefits:

1. Improved supplier relationships

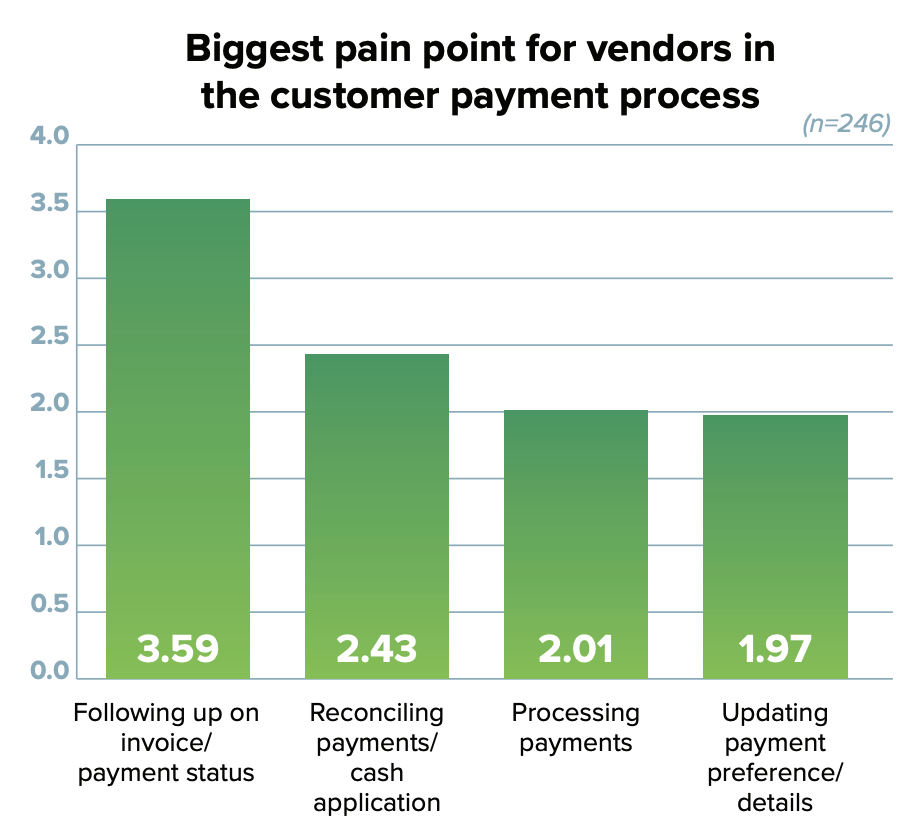

Data from MineralTree’s recent State of AP Report highlights the biggest pain points for vendors in the customer payment process, which are:

- Following up on invoice/payment status

- Reconciling payments/cash application

- Processing payments

- Updating payment preference/details

Businesses can greatly improve their interactions with suppliers by eliminating physical documents and transitioning to electronic invoice capture. Paperless processes also enhance the ability to track invoice status and reduce the incidence of duplicate payments. Such efficiency and accuracy foster stronger, more reliable relationships with suppliers as transactions become smoother and more transparent.

2. True bi-directional sync

A key feature to look for in AP automation technology is true bi-directional synchronization, which ensures that data flows seamlessly between the AP automation software and the ERP system to maintain data consistency and accuracy across systems. This level of integration is crucial for maintaining real-time financial insights and operational efficiency.

Did you know? MineralTree offers a true bi-directional sync so that changes made in MineralTree or in Sage Intacct are reflected in either platform.

3. More payment options

AP automation expands the range of payment methods available to businesses, allowing them to accommodate vendor preferences and streamline payment processes. In particular, AP teams often struggle with check runs, which causes delays and disruptions due to manual processes and outdated solutions. By automating check runs and incorporating digital payment methods, companies can avoid the delays and inefficiencies associated with manual payment processes.

Nearly all companies (94%) still use checks to some extent, according to the State of AP Report. Of these, 36% still make more than half of their payments by check. Against this backdrop, the ability to offer alternative, more efficient payment options like virtual cards and ACH payments represents a significant operational improvement.

Did you know? MineralTree offers a wide range of payment options, including checks, ACH, or SilverPay, a free, secure virtual card payment. That’s in addition to MineralTree’s collaboration with American Express.

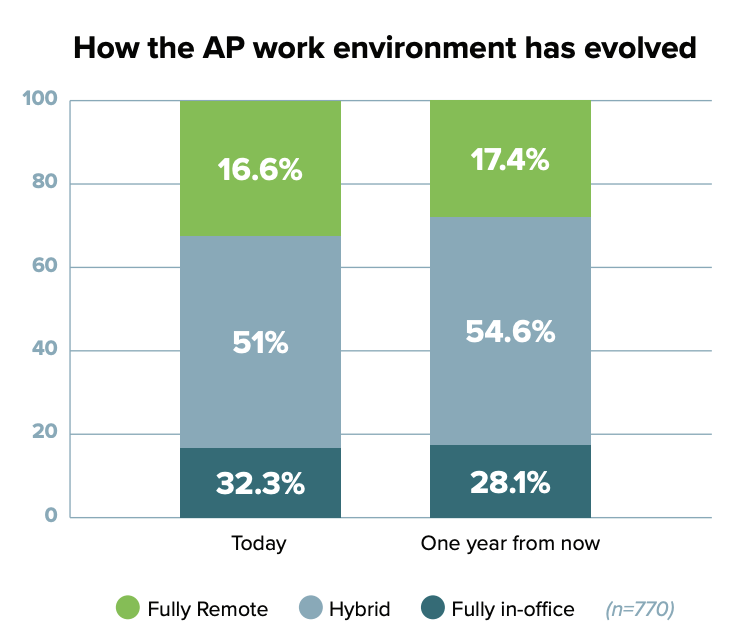

4. Optimized for a hybrid and remote workforce

The shift towards hybrid and remote work models has made cloud-based platforms like Sage Intacct increasingly important for ensuring business continuity and scalability. In fact, according to the State of AP Report, 67.6% of companies are currently hybrid or remote.

Cloud-based platforms support a distributed workforce by eliminating the physical presence required by paper-based processes. This enables teams to collaborate effectively, regardless of location.

Did you know? Platforms like MineralTree don’t charge on a per-user basis, making it easier for teams to collaborate no matter where they are located.

Case Study: BrightView supports business growth through a paperless process

Consider the journey to paperless AP processes undergone by BrightView Health, an outpatient medication-assisted treatment network in Ohio and Kentucky. As the company rapidly expanded, its manual AP processes became increasingly unstable. In fact, roughly 65-80% of BrightView’s invoices were still being delivered by mail, which meant someone had to scan them and manually enter line-level detail into the accounting system—a time-consuming effort that had become completely untenable now that the company was processing more than 10,0000 invoices annually.

BrightView turned to MineralTree to automate its AP operations in Sage Intacct. MineralTree’s invoice capture and AP automation have significantly reduced the time the company spends on quality assurance. The result is a dramatic increase in efficiency, with MineralTree’s invoice capture and automation features making BrightView’s entire AP process faster, more accurate, reliable, and streamlined for audit preparations.

Final thoughts

Moving toward a paperless accounts payable system with Sage Intacct is critical in an organization’s broader digital transformation journey. Integrating MineralTree’s AP automation solution eliminates inefficiencies in paper-based processes—enhancing operational efficiency, improving supplier relationships, and supporting businesses as they grow and scale.

Learn more about how your business can leverage MineralTree’s automation solutions to move to a fully paperless AP system with Sage Intacct.

Sage Intacct and paperless AP FAQs

1. What is paperless AP?

Paperless AP (accounts payable) refers to the process of managing supplier invoices and payments by utilizing digital workflows and electronic documents. This approach streamlines operations, reduces errors, and improves efficiency by automating invoice capture, approval, and payment.

2. How do you track accounts payable in Sage Intacct?

In Sage Intacct, accounts payable can be tracked using the platform’s comprehensive accounting features. These include capabilities that create supplier records, enter and manage invoices, and process payments electronically. Users can easily monitor outstanding balances, due dates, and payment history through customizable dashboards and detailed reports, ensuring accurate and up-to-date financial oversight.

3. How does AP automation software help finance teams go paperless?

AP automation software helps finance teams go paperless by digitizing invoice capture, approval processes, payment methods, and document storage, reducing reliance on paper-based processes.

4. Can AP automation software help improve supplier relationships?

Yes, AP automation software can improve supplier relationships by eliminating physical documents, offering transparent tracking of invoice status, reducing errors, and making payment processes more efficient.

5. What is true bi-directional synchronization, and why is it important in AP automation?

True bi-directional synchronization ensures seamless data flow between AP automation software and ERP systems like Sage Intacct, maintaining data consistency and accuracy across platforms for real-time insights.