Optimizing your AP process

QuickBooks is the obvious first choice for many small businesses seeking an accounting software solution. This ERP is easy-to-use and can help businesses fulfill many of their basic needs. While the platform continues to serve small and mid-sized businesses (SMBs), growing organizations often require a more robust solution.

That’s why many finance teams have made the switch from QuickBooks to Sage Intacct. This migration necessitates thorough data testing, employee training on the new system, and a comprehensive transition plan. But the right accounts payable (AP) automation solution can help bridge the gap for a smooth migration process, ensuring data accuracy and consistency—and an overall more efficient AP process.

Key takeaways

- QuickBooks provides essential financial tools and a user-friendly interface to smaller businesses and startups, but the platform requires manual functions like reporting with Excel.

- The need for scalability and advanced functionality has driven many businesses to migrate to Sage Intacct, an ideal accounting solution for mid-sized and large businesses.

- Integrating Sage Intacct with an AP automation platform facilitates seamless migration from QuickBooks by maintaining data consistency and enhancing the end-to-end accounts payable process.

Sage Intacct vs. QuickBooks: Key differences

QuickBooks and Sage Intacct are ERP tools that cater to businesses of various sizes and address different needs for complexity. QuickBooks offers a user-friendly interface and basic accounting functionality suitable for smaller organizations. However, its reporting process can be cumbersome as it typically requires manual intervention with Excel.

On the other hand, Sage Intacct is tailored for mid-market and large businesses. It boasts more advanced reporting capabilities, increased customization, and automation features that QuickBooks lacks. Below is an overview of key differences between the two platforms.

| QuickBooks | Sage Intacct | |

| Target market | SMBs | Mid-sized and large businesses |

| Reporting process | Manual reporting with Excel | Robust reporting capabilities within the platform |

| Scalability | Moderate | High |

| Cloud/non-cloud | Both | Cloud-native |

Why companies migrate from QuickBooks to Sage Intacct

Anivive Lifesciences Inc. was seeking FDA approval for a product. After securing approval and funding, the company transitioned from its seed stage to a growth period—and QuickBooks’s limitations quickly became apparent.

The lack of revenue management capabilities, difficulties in inventory management, and the need for manual data entry across multiple systems prompted the organization’s search for a more robust and scalable platform.

Similar to Anivive Lifesciences, many businesses that experience rapid expansion require a more advanced accounting platform to accommodate higher invoice and payment volume, more sophisticated reporting needs, or other demands. That’s why many fast-growing businesses are migrating to more scalable solutions like Sage Intacct.

Sage Intacct offers features like multi-entity and global consolidation, advanced revenue recognition, and the ability to create custom reports. With Sage, businesses can also maintain efficient financial operations without the need for extensive hardware maintenance or manual data archiving. As businesses scale and their needs become more complex, they will need to consider alternative solutions. In fact, 37% of companies are actively considering moving away from QuickBooks.

When should companies consider an ERP migration?

Avoid waiting until the last minute to migrate to Sage. You need time to plan and ensure team members are equipped to use the new platform. Additionally, waiting to make the switch until your business has outgrown QuickBooks can cause a number of problems and hinder business operations.

Signs indicating the need for a migration

If your business is experiencing any of the issues listed below, it may be time to consider making the switch from QuickBooks to Sage.

- Difficulties in generating reports due to high data volumes

- System slowdowns resulting from data volume growth

- The inability to get users access and role-based accounts

Did you know? An ERP migration is a huge investment and often takes place over the course of several months. Additional tools, such as AP automation platforms, can help businesses extend the lifespan of QuickBooks by offering increased functionality and analytics. While this won’t entirely eliminate the need for an upgrade, it can grant your business more time.

What are the benefits of migrating from QuickBooks to Sage Intacct?

Migrating from QuickBooks to Sage offers a number of competitive advantages to your business, which we explore further below.

- Ability to scale

- Easier reporting and better data

- Flexibility

- Automated processes

- Improved security

- Seamless collaboration between team members

- Role-based approvals

- Inventory management

- Revenue recognition

- Faster time for closing the books

Ability to scale

Cloud platforms like Sage Intacct offer integration capabilities essential for digital transformation and scalability. With Sage Intacct, you can customize and extend your financial management systems without risk. As your business grows and your needs change, Sage Intacct can scale with you. Sage Intacct also makes it easy to consolidate multi-entity support by providing comprehensive insights via one dashboard. Teams can quickly establish new business units and entities in their ERP software through configurable rules that make it easy to personalize accounting needs.

Easier reporting and better data

Many businesses that migrate from QuickBooks cite its limited reporting capabilities as a reason. Case in point? According to Sage, around 1 in 2 SMBs using QuickBooks want better reporting tools, and 45% are seeking better data. Further, 3 out of 4 financial executives also note that switching between their current tools and Excel is a major source of frustration.

Sage Intacct addresses these needs by offering comprehensive, customizable reporting features that reduce the manual data entry burden. As a result, your team can perform more accurate and insightful financial analysis.

Flexibility

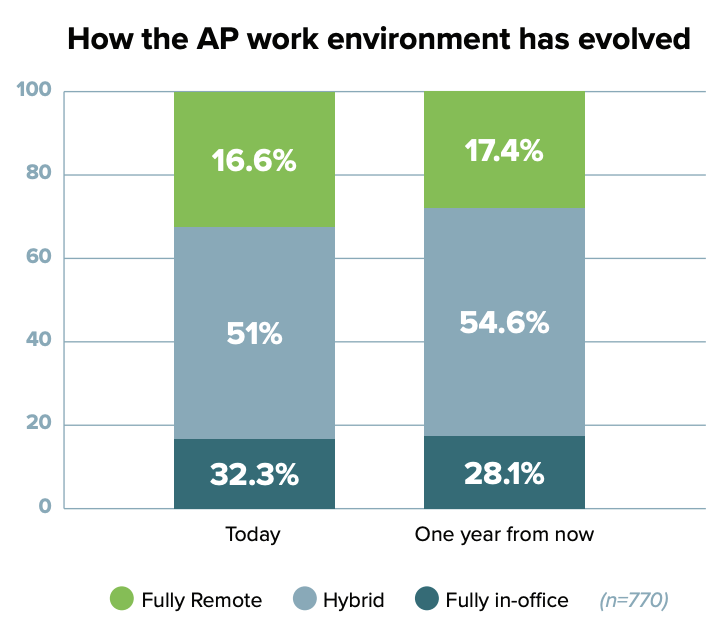

Research from MineralTree’s recent State of AP Report found that 68% of finance teams work in a hybrid or remote environment. Desktop-based solutions can make it difficult to account for a hybrid workforce. The cloud is becoming increasingly important for teams, with 91% reporting the importance of their organizations investing in cloud-based systems.

Cloud-based ERP tools like Sage Intacct are available at any time from any location, which is critical in providing flexibility to hybrid and remote teams.

Automated processes

Automation unlocks efficiency by reducing the need for manual interventions, minimizing errors, and saving time. Automated processes also minimize the overhead needed to accomplish the same task. Additionally, 26% of teams noted that manual data entry is an obstacle when it comes to QuickBooks.

Did you know? Sage Intacct excels in automating complex financial processes, and integrating it with MineralTree makes this capability even more powerful. The integration enables you to automate your entire AP process for even greater efficiency and accuracy.

Improved security

Sage Intacct offers robust, built-in data security measures. The platform also ensures that software updates and maintenance activities do not disrupt user operations, providing a seamless and secure user experience.

Seamless collaboration between team members

The Sage platform promotes seamless collaboration among team members by facilitating easy access to financial data and reports—no matter where team members are located. This is especially important because, according to the State of AP Report, 67.6% of AP work environments are hybrid or fully remote. These cloud-based advantages enhance productivity and support better decision-making.

Role-based approvals

QuickBooks does not feature invoice approval functionality inside the software itself. Sage Intacct allows for sophisticated role-based access and approvals, enabling secure and efficient workflows.

Did you know? Integrating Sage with MineralTree can further enhance this feature by incorporating different tiers of payment approvals for even more granular control. Additionally, MineralTree optimizes this workflow for a hybrid environment by allowing all invoice approvals to be done via email.

Inventory management

Unlike QuickBooks, Sage Intacct provides advanced tools for inventory management, including support for purchase orders and compliance reporting. This eliminates the manual paperwork typically associated with purchase orders, making it easier to manage your inventory and remain compliant with relevant regulations.

Revenue recognition

Public companies in the U.S. (and most companies in general) have to comply with revenue recognition standards set by the Financial Accounting Standards Board. The Sage platform offers robust tools that help you simplify financial reporting and recognize revenue more consistently and accurately.

Faster time for closing the books

Sage Intacct’s automated processes and real-time financial operations enable you to complete your month-end and year-end closings faster than with QuickBooks. Eighty-eight percent of financial executives using QuickBooks note that the month-end close process takes up to 14 days. They also noted that data inaccuracies, reconciliation, and the limitations of the technology are the biggest hindrances to facilitating this process.

- Plan the migration process

- Choose the right integration solution or partner

- Test data accuracy and completeness

- Train new employees on the system

- Create workflows and processes

- Consider if the integrations are compatible

6 tips for migrating from QuickBooks to Sage Intacct

The switch from QuickBooks to Sage Intacct requires a thorough migration plan, safeguards around data accuracy, and robust employee training, which we discuss below.

1. Plan the migration process

Develop a comprehensive migration plan that outlines every step of the process, including data cleanup, system setup, and testing phases. Your plan should also include timelines for each task and define the roles and responsibilities of each team member to ensure a smooth transition.

2. Choose the right integration solution or partner

Selecting an experienced partner with a reliable integration solution is critical for a successful migration. Start by searching for providers with a proven track record of QuickBooks to Sage Intacct migrations. Your partner must have a deep understanding of your business processes and the ability to tailor the Sage Intacct setup to meet your company’s specific needs.

3. Test data accuracy and completeness

It’s critical to thoroughly test your migrated data for accuracy and completeness before going live. This involves verifying that all financial records, including historical data, have been accurately transferred and are reflected correctly in Sage Intacct.

4. Train employees on the new system

Ensure your team is comfortable and proficient with Sage Intacct by providing comprehensive training sessions. Training should cover all relevant features and workflows your team will use—and don’t forget to leave plenty of time for questions.

5. Create workflows and processes

Take your migration as an opportunity to review and possibly re-engineer business processes and workflows so you can fully leverage Sage Intacct’s capabilities. This might involve setting up new approval hierarchies, automation rules, or customized reporting dashboards.

6. Consider if the integrations are compatible

Review all your current software integrations and triple-check that they are compatible with Sage Intacct. This includes checking whether your AP automation solution, CRM, and other critical business systems can integrate with Sage Intacct for seamless data flow and processes.

Migrating from QuickBooks to Sage Intacct with MineralTree

The migration from QuickBooks to Sage Intacct may feel daunting. But MineralTree provides features that help make your migration seamless, which we explore below.

- Keep the same AP platform

- Leverage ERP migration support

- Test MineralTree in a sandbox environment

- Streamline the payment experience in Sage Intacct

- Gain unlimited seats

- Create a more efficient AP process

1. Keep the same AP platform

MineralTree offers integrations with both QuickBooks and Sage Intacct, supporting a seamless transition. MineralTree’s bi-directional sync operates at five-minute intervals, ensuring data consistency and accuracy across your AP processes.

2. Leverage ERP migration support

If you aren’t sure how to begin your migration, you can lean on MineralTree’s implementation resources for support. The MineralTree team helps you ensure smooth setup and that data transfers correctly from QuickBooks to Sage Intacct. This support also includes checking that all invoice data in the cloud is accurately migrated.

3. Test MineralTree in a sandbox environment

MineralTree allows you to test its functionalities within a Sage Intacct sandbox environment. The cautious approach ensures that everything operates as expected before you go live with the new system.

4. Streamline the payment experience in Sage Intacct

MineralTree enhances your payment process by supporting a variety of payment methods beyond just checks and ACH. The platform’s native integration with American Express and the use of virtual cards through SilverPay offer secure and efficient payment options.

5. Gain unlimited seats

Unlike many other platforms, MineralTree’s pricing model is based on the volume of invoices processed rather than the number of users. This approach allows your entire team to collaborate on the platform without worrying about additional costs per user.

6. Create a more efficient AP process

By migrating to Sage Intacct with the support of MineralTree, your team can forge a more efficient and effective AP process. With greater visibility into your data, more streamlined payment approvals, and efficient invoice capture, you can curtail manual data entry and lower the risk of errors. Meanwhile, real-time insights into cash flow and financial obligations empower you to make more informed decisions about your business.

Final thoughts

The migration from QuickBooks to Sage Intacct is a strategic move for businesses aiming to leverage advanced features to improve financial management. Sage Intacct’s cloud-based platform provides stronger security, new functionalities like inventory management, and easier access to workloads for hybrid and remote teams. With MineralTree, the migration from QuickBooks to Sage Intacct doesn’t have to be a headache. Instead, you can reap the combined benefits of MineralTree and Sage Intacct, from scalability and automation to first-rate AP efficiency. Additionally, MineralTree can enhance the features of Sage Intacct, allowing your team to streamline the entire AP process better.

Schedule a demo and discover how you can streamline your AP process.

Sage migration FAQs

1. Can you transfer Quickbooks to Sage?

Yes, transferring workloads from QuickBooks to Sage is possible and often a strategic move for businesses seeking more advanced financial management features. The process involves exporting financial data from QuickBooks and then importing it into Sage, using either built-in import tools provided by Sage or through the assistance of third-party data migration experts.

2. Is Sage Intacct or QuickBooks a better program?

Deciding between Sage and QuickBooks hinges on your business’s scale and requirements. QuickBooks offers user-friendly functionality and affordability for small- to medium-sized businesses. It’s well-suited for organizations needing basic financial management tools.

Conversely, Sage Intacct caters to mid-sized to larger businesses, providing advanced features and greater scalability. It’s the go-to for companies seeking comprehensive financial management with detailed reporting and industry-specific options. The choice between the two depends on the complexity of your financial needs and the level of functionality you require to manage your business’s finances effectively.