Overview

This fast-growing healthcare practice management company offers high-quality dental, vision, and orthodontic services with a specialization in pediatric patients. The company focuses primarily on providing care to underserved communities across the United States and has helped over one million children gain access to the care they need.

Key Challenges in Accounts Payable

- Fast-growing business fueled by both organic success and acquisition

- An increasingly high volume of vendor invoices

- Complex financial processes as a result of multiple ERP instances

- Siloed payment information

- Highly manual AP processes create time-consuming work and errors for staff

- Unhappy vendors due to payment delays, errors caused by manual processes

The Solution for Improving the AP Process

- Implementation support to help the company successfully launch a new accounting and AP automation system

- End-to-end AP automation from invoice receipt through vendor payment powered by MineralTree TotalAP

- Seamless integration with the company’s new Sage Intacct ERP system

- Digital payment options, including virtual cards earning valuable cash-back rebates

The Results of AP Automation

- ~20% time savings for staff accountant

- Reduced quarterly close time by 67% (from 30 to 10 days)

- Improved team productivity by redeploying two FTEs to higher-value tasks

- Optimized user experience for the finance team, increased retention, and supported higher morale

- Optimized cash flow visibility and simplified reporting on key financial metrics for senior management

- Faster invoice approvals and more timely vendor payments, resulting in more favorable payment terms and lower pricing

- The majority of all payments are now automated through MineralTree

“Before MineralTree, the company had five people focused entirely on AP, including one whose entire job was organizing thousands of physical invoices received, and moving invoices from the ticket portal to load onto the servers. Another person’s role was manually entering the invoice details. Today, with MineralTree’s automation capabilities, the company is handling that same volume of invoices with just three people.”

Customer Background

This healthcare practice management company’s mission is based on the belief that access to quality dental, vision, and orthodontic care has a lasting impact on a child’s health, confidence, and school performance. To deliver on that mission, the company has focused on ensuring every child has access to the care they need.

- Comprehensive care services under one roof—so busy parents can schedule all their children’s important check-ups in a single visit.

- Welcoming Medicaid and most insurance plans at all its practices— so parents can get their children the care they need without stressing about the cost.

- Making care fun—from kid-friendly waiting rooms and treatment areas to highly trained staff, the company’s dental, vision and orthodontic practices go out of their way to make kids and their parents feel comfortable.

The management company supports dozens of practices across 35+ legal entities in seven states. The practice model is pediatric dental, orthodontics and related specialties and vision care. Each practice is a one-stop shop for children’s care, be it in one, two, or all three areas.

The primary care recipients are children in Medicaid recipient families, an underserved population for whom getting to the doctor is more difficult than most. For these kids, the ability to address multiple care needs in the same visit can make a significant difference in a child’s health.

The management company’s business model is based on shared ownership, with each practice typically co-owned by a physician or group of physicians and the management company. Physicians pay the management company an internal ‘fee’ to contract for administrative support, accounting/bookkeeping, payroll, and marketing. Sharing these services across all the practices provides efficiencies while also enabling each physician group to focus on providing the best possible patient care.

The Challenge in Accounts Payable:

Manual Payment Processes and Operational Inefficiencies Impede Business Growth

The management company has been on a significant growth trajectory—around 10% per year—fueled by the expansion of existing practices to meet demand and the acquisition of new practices.

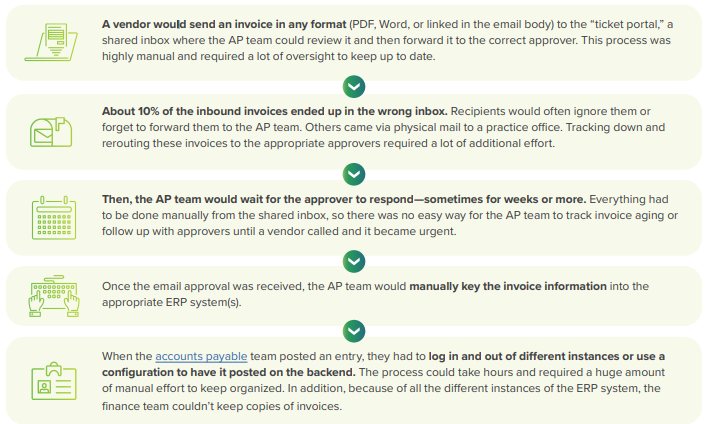

The CPA and VP of accounting joined the management company’s staff in mid- 2020. At the time, leadership was emphasizing good data, improved financials,and reliable information to support the company’s growth. This individual was specifically tasked with improving the company’s AP and accounting processes to support its physician practices from a centralized model. At the time, the management company’s existing ERP system required 70 different instances of the software. In addition to the work required to maintain data in all these systems, it was very difficult to automate and standardize processes across the business. The AP workflow was a prime example:

The process of making a payment to a vendor was equally manual. The AP team either had to go into the office to write checks and mail them or download a file and upload it directly to the bank.

The CPA/VP of accounting set out to change all of this by working with the CFO to upgrade the management company’s accounting, credit cards, AP, payroll, and timekeeping systems. She focused on finding software solutions that could serve all of the company’s healthcare practices from a central point of management and deliver efficiencies by automating workflows and eliminating manual errors wherever possible.

The Solution for a More Streamlined AP Process:

End-to-end AP automation seamlessly integrated with the management company’s Sage Intacct ERP system

The CPA/VP of Accounting had an ambitious plan—to replace the company’s ERP system after deploying an AP automation system that could work with both systems seamlessly.

For its ERP system, the company chose Sage Intacct based on internal recommendations and Sage’s ability to support its decentralized business structure. It was also the right fit for the organization’s size and goals.

For AP automation, the CPA/VP of accounting leaned on her team to understand the critical pain points that needed to be addressed: receiving invoices in the right format, getting invoice approvals quickly and easily, and having a tracking mechanism to ensure processes were flowing smoothly. She focused the evaluation on four different AP automation solutions based on team members’ prior experience, peer reviews, and outreach from the different solution providers. Her team was also looped in to ensure the day-to-day nuances of each person’s role were considered.

Ultimately, the company selected MineralTree’s TotalAP automation solution as the best way to immediately streamline its end-to-end AP process while preparing for the ERP upgrade, increase the team’s productivity, provide

better visibility for the business, and save internal resources.

The implementation process went smoothly. Pulling all the data together for the initial set-up was critical, and MineralTree’s implementation team made sure everything worked properly. The data was accurately transferred and worked correctly the next day.

The transition from its existing ERP system to Sage Intacct went smoothly as well. To help ensure this, MineralTree implemented its AP solution into the company’s existing ERP system while they were upgrading to Sage Intacct. At the same time, MineralTree set up a staging environment for the client to implement and begin testing with Sage Intacct before switching over.

Benefits of MineralTree

Several key features in MineralTree helped transform the management company’s AP process:

- OCR + HUMAN REVIEW: Eliminating manual data entry for the AP team and ensuring data coding accuracy was a top priority.

- BULK IMAGING: he finance team often receives 100 invoices in a single file. With MineralTree, all these invoices are recorded and entered automatically.

- APPROVALS: MineralTree tracks approvals, sends automatic reminders, and provides easy visibility for the AP team. This enables easier conversations with the approvers knowing they are receiving notifications.

- APPROVER UX: Approvers can process invoices quickly and easily from their desktop or phone in seconds without having to log in.

- REPORTING: The management company uses various capabilities, including tracking and viewing what’s due within 30 days, what’s unpaid, and running standard but crucial AP reports.

- FILTERING: The AP team can filter by different parameters in the tool, such as invoices coming due, to stay ahead of vendor calls chasing payments, ensure they are taking advantage of payment discounts, and enable easy scheduling of payment batches.

- PAYMENT POSTING: Outgoing payments queued in MineralTree are visible in Sage Intacct, making end-of-month closing easier.

- INVOICE COPIES: The finance team has images of every single invoice in both MineralTree and Sage Intacct.

- PAYMENT DATA CONSOLIDATION: All payment information is housed in MineralTree, allowing the management company’s AP team to digitize and expedite payments.

- CLOUD-BASED: The former ERP system was very slow to load different instances. Now, the AP team can access this cloud-based AP platform securely, quickly, and easily from anywhere.

Overall, MineralTree has made the AP team significantly more efficient and their day-to-day jobs a lot more satisfying.

The Results of Implementing AP Automation:

MineralTree delivered value for the client almost immediately by eliminating manual processes and providing important operational efficiencies across the entire company. Those benefits continue to build.

INCREASED TIME SAVINGS

- Before deploying MineralTree, the management company’s finance team had five people focused entirely on AP, including one whose entire job was organizing thousands of physical invoices received, and moving invoices from the ticket portal to load onto the servers. Another person’s role was to manually enter the invoice details into the ERP system. Today, with MineralTree’s automation capabilities, the finance team can handle that same volume of invoices with just three people.

- A staff accountant used to be required to check the ticket portal several times a day to provide support. This individual helped answer questions, ensured items were sent out to appropriate approvers, and followed up with vendor inquiries. Since implementing MineralTree, this process is no longer required and has freed up approximately 20% of the staff accountant’s time, allowing them to focus on strategic initiatives.

IMPROVED VENDOR RELATIONSHIPS

- The company no longer worries about a utility being shut off by surprise, or about delays in shipments because they were unaware of unpaid invoices.

- More timely vendor payments have also led to more favorable payment terms and lower pricing.

ENHANCED VISIBILITY, REPORTING, AND INTELLIGENCE

- MineralTree helped the client’s leadership easily review financial data, both as an organization and at a practice level. It also eliminated the time that some operational leaders used to spend with vendors inquiring about invoices.

- The client’s AP team members are now able to analyze trends. This way, they know if a regular invoice is missing and can be proactive and ask vendors about them.

EMPLOYEE SATISFACTION

- MineralTree enabled the CPA/VP of Accounting to reconfigure her AP team so that each team member has clearly defined tasks. Each person knows what they need to do each day, and they appreciate the consistency, ability to plan, and predictability that comes as a result.

- Since implementing MineralTree, the AP team hasn’t had any turnover. The CPA/VP of accounting believes this is because people are able to make a bigger impact, which ties directly to employee retention and satisfaction.

“Invoice capture and coding was the client’s biggest pain point. MineralTree turned it into a huge timesaver by capturing the data accurately with little rekeying ever needed.

With MineralTree and Intacct, the management company’s finance team now has the ability to easily identify and contact vendors to redirect invoices to the AP team when needed. This has increased the AP team’s efficiency and improved relationships with vendors, who appreciate that following the correct process gets them paid more timely.”

Taking Advantage of Time Savings

The healthcare practice management company’s finance team has been able to focus on other initiatives to optimize operations as a result of the time savings realized through AP automation. A “special project” team identified $150k overpayment on rent for one of their medical practices. When the lease was initially put in place, the rent schedule was set up based on the first invoice paid, which included a deposit. The recurring invoice was submitted as the rent and deposit amount until the special project team caught and resolved the issue.

Looking Ahead

As the company continues to expand its MineralTree implementation, the CPA/VP of accounting is looking for new ways to leverage the platform’s full capabilities. One of those areas is getting more strategic about

precisely when and how to make payments to optimize cash flow and take advantage of vendor discounts and virtual card rebates. Some of this will be realized by working with the MineralTree team and the platform’s data intelligence engine and dashboards.